Crypto Hacked or Stolen? Lawyer’s 15 Steps to Recovery

Dilendorf Law Firm’s crypto attorneys help victims recover stolen digital assets from major U.S. cryptocurrency exchanges, even in complex cases—such as when a victim’s phone is stolen and hackers exploit the device and its apps to execute unauthorized transfers from crypto accounts.

Whether you’ve been hit by a SIM swap, social engineering attack, account takeover, or a sophisticated breach involving a compromised device, time is critical. Below are key steps to protect your assets, document the breach, and pursue recovery.

Upon discovering unauthorized activity, you should immediately notify your financial institution in writing (preferably via certified mail) to preserve all legal rights and establish a formal record of the incident. Below are key steps to protect your assets, document the breach, and pursue recovery.

Remember, these suggestions may not cover every scenario, so it’s important to seek individualized legal advice before taking formal action.

- Secure Your Devices and Accounts.

Protect every device you own. Update antivirus software, install the latest security patches, and immediately change all your passwords. Lock your credit reports to prevent unauthorized activity. Call your phone carrier to confirm your phone is secure and add a PIN for extra security.

- Notify the Exchange Immediately.

Reach out to the exchange right away. Provide the blockchain wallet address where your funds were transferred and request that they freeze the wallet, monitor its activity, and seize the funds if they reach an onramp. While the chances of the exchange acting are nearly zero, this step is crucial for building a record and improving your odds of recovery later.

- Don’t Blame Yourself.

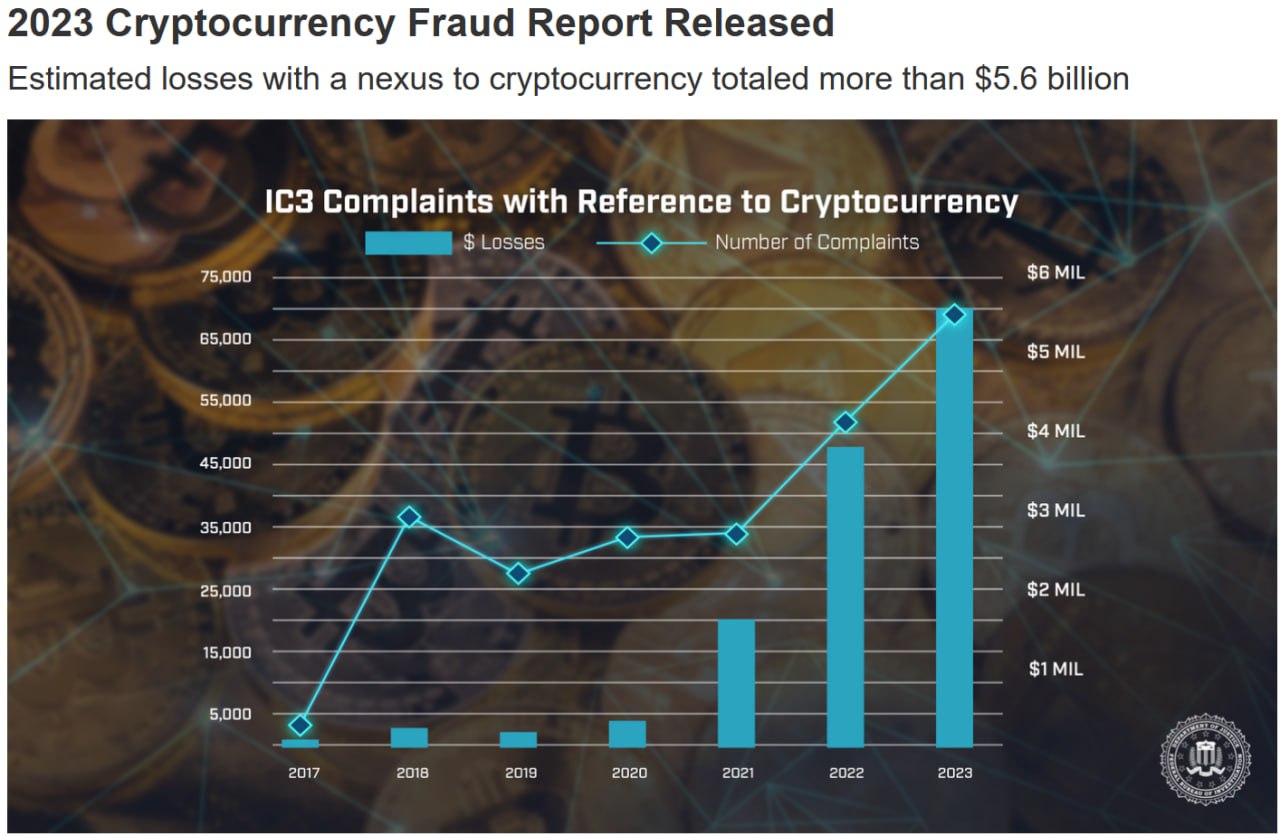

These attacks are highly sophisticated, often carried out by organized criminal syndicates or state-sponsored actors. In 2023 alone, the FBI reported $5.6 billion in stolen cryptocurrency. Remember, your crypto exchange is your first and last line of defense to protect and safeguard your assets. Focus on taking action, not on self-blame.

- Preserve and Document All Evidence.

Keep a detailed record of everything related to the breach. Save emails, call logs, screenshots, transaction records, and any communication with the exchange. This evidence will be crucial for arbitration, legal proceedings, or any attempts at recovery.

- File an FBI IC3 Report.

Submit a report to the FBI’s Internet Crime Complaint Center (IC3). The online process takes about five minutes. While the odds of the FBI acting on your case are slim due to backlogs and resource constraints, filing the report is essential. You’ll need it for tax purposes and to support your arbitration claim.

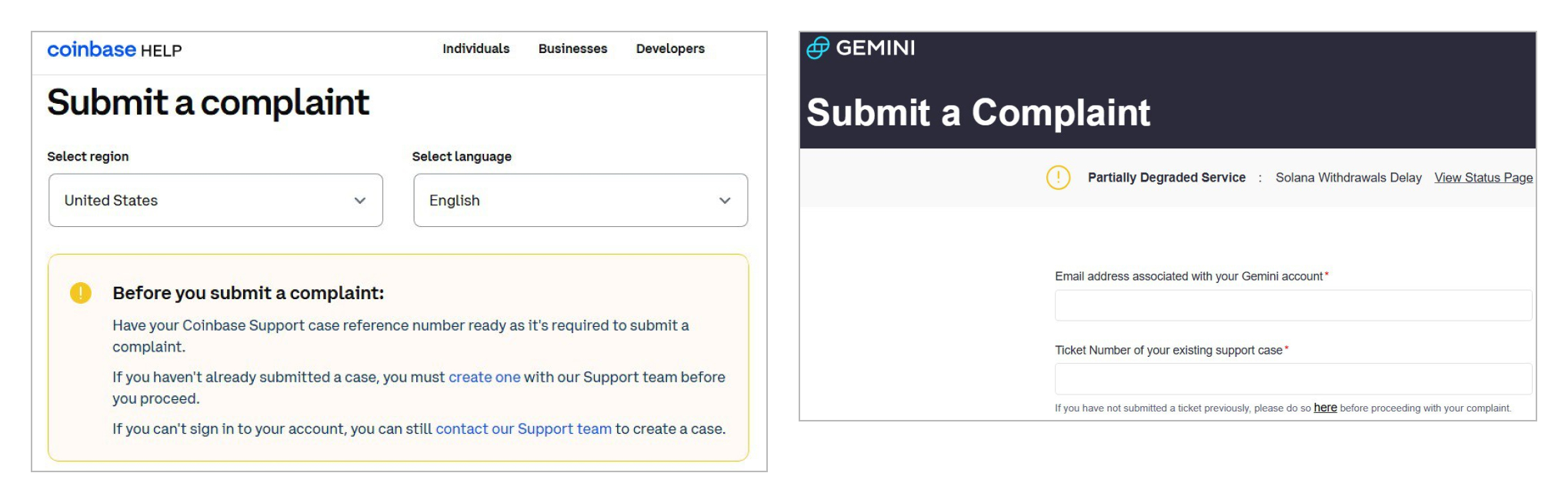

- Provide Formal Notice to the Exchange.

If the exchange is liable for transferring your funds to unauthorized individuals during an account takeover (ATO), you must provide formal notice under the terms of the user agreement. For Coinbase, this requires a 45-business-day notice before you can file an arbitration claim. For Gemini, the notice period is 60 days. Meeting these deadlines is critical to preserving your rights.

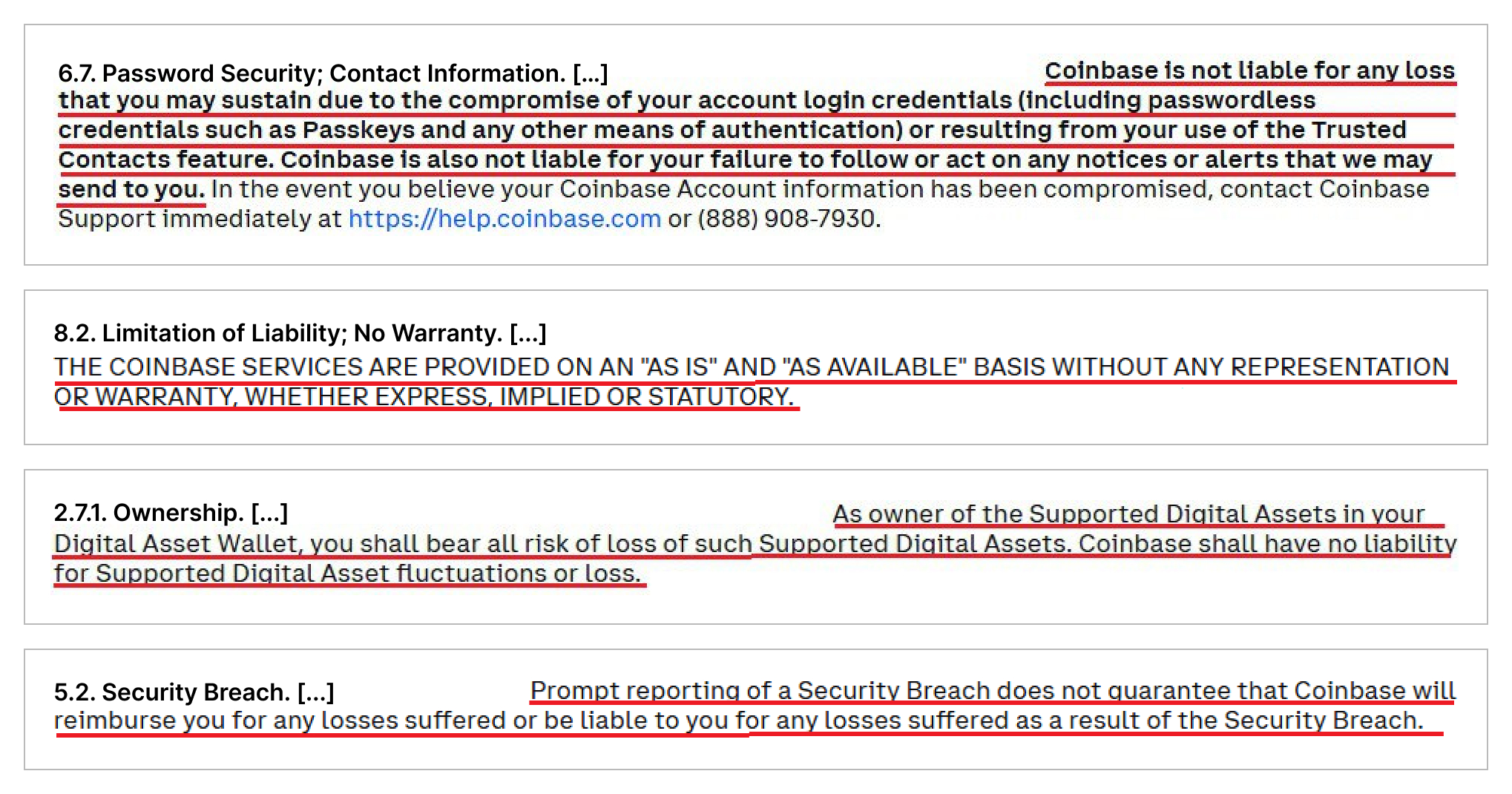

- Understand Exchange Liability.

Under Coinbase’s user agreement, for example, the company is not responsible for thefts on its platform. The risk of loss falls entirely on the customer, and the company disclaims liability if your credentials are compromised and funds are stolen.

- File Complaints with Regulatory Authorities.

If you believe the exchange is at fault for transferring your funds without authorization during an account takeover (ATO), file complaints with the appropriate authorities. This includes local banking regulators overseeing the exchange, local consumer protection agencies, and federal agencies such as the CFPB and CFTC. If the exchange is licensed in New York, file a complaint with the New York Department of Financial Services (NYDFS), which regulates virtual currency businesses. These complaints help establish your case and bring regulatory attention to the incident.

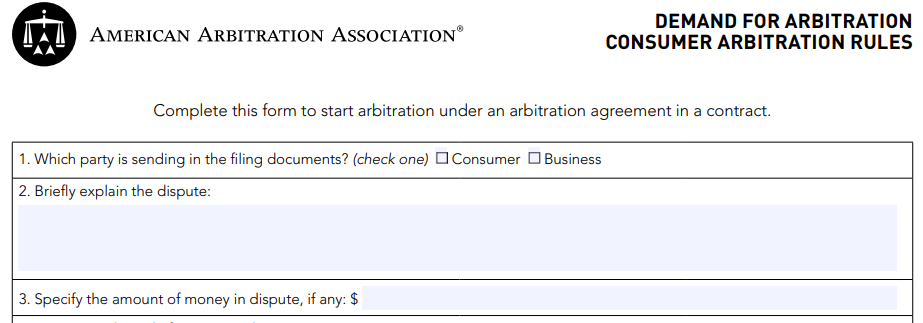

- Begin Arbitration Demand After the Notice Period.

Once the formal notice period required by the user agreement has passed—typically 45 business days for Coinbase or 60 days for Gemini—you can file an arbitration demand against the exchange. The arbitration will be handled by a designated forum, such as AAA, NAM, or JAMS, as specified in your user agreement. Carefully review the agreement to confirm where your case will be heard. Arbitration is the next step in pursuing recovery.

- Engage Professional Legal Assistance.

It is highly recommended to involve an experienced attorney in your case. Arbitration heavily favors exchanges due to the terms of their user agreements, which often disclaim liability for thefts and require customers to use the platform on an “as-is” basis with no representations or warranties. Without professional legal support, consumers are at a significant disadvantage in these proceedings. An attorney can help level the playing field and ensure your claims are properly presented.

- Hire a Blockchain Forensics Firm.

Contract a professional blockchain forensics firm to trace where your stolen funds were sent. These firms specialize in tracking blockchain transactions and can identify wallets involved. In some cases, they may assist in working with exchanges or authorities to recover your assets.

- Prepare Your Arbitration Demand Carefully.

Your arbitration demand must include all applicable claims and adhere to the statute of limitations. Missing critical details or deadlines could weaken or void your case.

- File an Arbitration Demand.

After filing your arbitration demand, expect the process to take 9 to 12 months. This will include depositions, testimony from expert witnesses, discovery motions, and a final evidentiary hearing lasting up to five days. Arbitration is typically conducted online, with all parties, arbitrators, company representatives, and experts participating remotely. Be prepared for a detailed and lengthy process.

- Choose a Skilled Arbitrator.

Request a list of five arbitrators and carefully review their qualifications. Select one with expertise in cybersecurity claims and a reputation for fairness to consumers. The arbitrator’s experience and approach can play a critical role in the outcome of your case.

- Understand the Finality and Confidentiality of Arbitration.

Arbitration decisions are final and cannot be appealed, except in exceptional circumstances, such as proven arbitrator bias. The proceedings are confidential and bound by a protective order required by the exchange. These cases never reach the public eye—exchanges actively ensure that thefts on their platforms remain hidden from both the public and regulators.

Contact Us:

If your cryptocurrency was stolen from an exchange due to an account takeover, a stolen phone, or any unauthorized breach, don’t wait to fight back.

The experienced crypto attorneys at Dilendorf Law Firm are ready to guide you through the complex process of recovery, from navigating arbitration to leveraging federal protections.

Time is critical, and professional support can make all the difference. Reach out to Max Dilendorf today for assistance. Phone: 212.457.5757; Email: md@dilendorf.com.

Resources:

- Cryptocurrency – Internet Crime Complaint Center (IC3)

- NYDF Consumer Complaint

- AAA Consumer Arbitration Rules

- JAMS Comprehensive Arbitration Rules & Procedures

- Crypto Enforcement

- Modern Scams: How Scammers are Using Artificial Intelligence and How We Can Fight Back

- Cryptocurrency Fraud Report 2023

- Cryptocurrency: Selected Policy Issues

- Combatting Illicit Activity Utilizing Financial Technologies and Cryptocurrencies

- Crypto-Assets: Implications for Consumers, Investors, and Businesses

- Exploring the Cryptocurrency and Blockchain Ecosystem

- Crypto Assets

- What To Know About Cryptocurrency and Scams

- Digital Assets | CFTC

- Taxpayers need to report crypto, other digital asset transactions on their tax return

We stay up to date and track cases involving phishing attacks and sim swap affecting major cryptocurrency exchanges and mobile operators:

One of the largest cellphone carriers in the United States is facing yet another lawsuit by a digital currency investor over SIM swap fraud. T-Mobile failed in its duty to protect its users and resulted in the plaintiff’s loss of $55,000 worth of BTC, according to the lawsuit filed in Pennsylvania.

I am victim of a SIM Swap scam. Both T-Mobil and Coinbase.com where negligent and failed to protect me. I have all the evidence to prove my case.

An 84-year-old grandmother living in West Palm Beach started investing in cryptocurrency to help save up for her family’s future. Then, nearly all of the money she put into cryptocurrency vanished after she claims a hacker got into her accounts and drained it of about $800,000.

- Coinbase Reportedly Stealing Customer Funds, According to Complaint Documents Filed to SEC | CryptoGlobe |

Coinbase users have filed 134 pages of complaints to the SEC alleging that their funds have been “stolen” by the exchange

- T-Mobile Sued Again Over SIM Swap Crypto Losses | Law Street |

Yesterday, Kevin Frye filed a complaint in the Southern District of Florida against T-Mobile USA, Inc. for allegedly conducting a “SIM-Swap” without his consent, resulting in the loss of tens of thousands of dollars worth of cryptocurrency. The plaintiff claimed that “T-Mobile Representatives were either complicit with the theft or grossly negligent” since they have been on “notice for years that their security measures were not adequate.”

- SIM swapping victim alleges T-Mobile failed to stop $20,000 cryptocurrency scam | Cyberscoop | June 4, 2021

A Pennsylvania woman who lost the equivalent of $20,000 in cryptocurrency as part of a mobile fraud scheme says T-Mobile failed to protect her account in the face of a wave of similar incidents.

Nine months before scammers stole $20,000 from Kesler’s Coinbase account, the suit argues, Jack Dorsey was the victim of another high profile SIM swap, in which outsiders seized control of the Twitter CEO’s information. Security journalist Brian Krebs also covered the issue in 2018, specifically reporting that a T-Mobile retail store employee was under investigation for making an unauthorized SIM swa

- Man takes on Gemini and CIT in lawsuit after his $263,799.28 was allegedly stolen to purchase crypto

A man is suing Gemini, claiming it was negligent not to notice significant sums of money moved from his money market account to buy cryptocurrency on the exchange over seven days. While the trader was out of reach in the Australian outback, someone allegedly stole money from his CIT account and wired it to Gemini to purchase crypto. Later, he noticed fraudulent activity on his accounts with other banks, and is suing CIT in addition to Gemini, claiming it violated the Electronic Funds Transfer A

Hackers stole $21 million in Bitcoin and $15 million in Ethereum from retirement accounts held with IRA Financial Trust on February 8, according to a report from Bloomberg based on an anonymous source.

Interviews and thousands of complaints have revealed a pattern of account hacks where users have reported money vanishing from their accounts, reports CNBC. Once criminals gain access to an account, funds can be drained within minutes.

- Lost $350,000 in a hack, now Coinbase wants me to pay them $10,000 | Reddit User | March 15, 2022 – 5 months Ago

My account that my mom and I use together got hacked in June of this year. We lost $350,000.The hacker not only transferred out all of the crypto we owned, they used the bank accounts that were linked to purchase more. When we found out about the hack, we called our banks to stop the transfer of money. We also immediately contacted Coinbase to report the hack. However, Coinbase still let the purchase go through while the bank transactions were pending. Now, Coinbass is claiming that because we stopped our banks from transferring the money, we owe them $10,000 to reimburse them for the purchase.

California-headquartered crypto trading platform Coinbase—has been named in at least 115 complaints sent to the U.S. Securities and Exchange Commission and the California Department of Business Oversight

“I believe Coinbase has engaged in fraud by knowingly marketing a service it knows it cannot actually provide,” the filing from November last year read, adding: “Coinbase knows it does not have the infrastructure to timely and adequately meet customer needs.” At the time, bitcoin and other virtual currencies were rocketing in value, leading to an unprecedented interest from eager new investors.

It took only two minutes for the attacker to clean Sean Everett out of what was then a few thousand dollars’ worth of digital coins from his Coinbase wallet

- Coinbase once lost $250,000 of Bitcoin in phishing attack | Decrypt | May 22, 2020

Author Jeff Roberts said $250,000 was stolen from Coinbase in 2013/2014. Roberts claims Coinbase’s hot wallet was hacked just a year after the company’s inception in 2012, and that the hacker made away with $250,000 worth of Bitcoin

Olympia and Steve Kallman of Parma said they are dealing with some sleepless nights after police reported they had more than $22,000 taken by con artists from their Coinbase cryptocurrency virtual wallet back on Aug. 16.

- T-MOBILE SUED AFTER CLIENT LOST $8.7 MILLION IN CRYPTOCURRENCY HACK | Levin Law, August 12, 2021

T-Mobile is facing a multi-million dollar lawsuit after hackers were able to gain unauthorized access to a client’s account. Using information provided by the cellular company, hackers successfully bypassed their two-factor authentication security measures enabling them to obtain a SIM card with the client’s personal and financial information. $8.7 million in cryptocurrency was ultimately transferred out of the customer’s account.

- T-Mobile Customer Sues T-Mobile After Losing $8.7 Million of Cryptocurrency Stolen in SIM Swap Scam | Dimond Kaplan & Rothstein, P.A.

T-Mobile has been hit with a multi-million-dollar lawsuit after Reginald Middleton lost millions of dollars when hackers gained unauthorized access to his account. The hackers used information supplied by T-Mobile to successfully circumvent the two-factor authentication measure, which allowed them to obtain a SIM card containing all of Middleton’s financial and personal information. Ultimately, $8.7 million in cryptocurrency was transferred out of Middleton’s account.

- Another Bitcoin Investor Sues T-Mobile Over SIM Swap Attack | Nasdaq | July 15, 2021

Richard Harris, the customer and plaintiff, is alleging T-Mobile’s misconduct including its failure to adequately protect customer information, hire appropriate support staff and its violation of federal and state laws led to his loss of 1.63 bitcoin.

Last night while I was sleeping my account was logged into (web) from Russia…

The Vidovics lost nearly $170,000 in the blink of an eye when someone hacked their Coinbase account.

John said his accounts with Coinbase and Coinbase Pro were emptied as he watched his phone screen.

- Coinbase User Accounts Emptied After Hackers Gained Access to Their Crypto Wallets | Couple Discovered $168K Crypto Stolen | Tech Times | August 25, 2021

….an increasing number of users of the currently highly popular cryptocurrency exchange called Coinbase have suddenly found their accounts on the platform empty. This is after hackers have managed to gain access to them and thoroughly drain their cryptocurrency wallets.

- Sim-swappers hack League of Legends star out of $200K worth of cryptocurrency from Coinbase account | TheNextWeb | September 18, 2018

League of Legends superstar has had $200,000 in cryptocurrency stolen from them – directly from their Coinbase account

…an unauthorized user had changed Ms. Maguian’a passwords for trading platforms… Coinbase and initiated transactions that emptied her accounts of crypto valued at around $80,000 at the time

- U.S. Court Rules Money Laundering-Related Case Against Coinbase Must Have Public Trial | Cointelegraph | April 24, 2018

The Eleventh Circuit Court of Appeals ruled today that the class action against Coinbase…will be held in open court. The case in question alleges that Coinbase assisted in laundering around $8.2 mln of stolen Bitcoin (BTC) – valued at over $100 mln today.

- Coinbase Cryptocurrency accounts wiped out ‘in an instant by cyber crooks | ABC Action News |

The Vidovics lost nearly $170,000 in the blink of an eye when someone hacked their Coinbase account.

Dr. Anders Apgar, a Coinbase customer, said his account had a balance of more than $100,000 in crypto when it was hacked during a robocall.

- Coinbase Account Hacked $14,000 USD stolen | Reddit User |

I had $14,000+ USD in my coinbase pro account. The account was hacked at the money was switched over to crypto and sent to multiple people this occured several hours ago (05/14/2021). Case # 06082303

- Cybercriminals cleanout cryptocurrency using sim card swap scam | ABC Action News

Tampa resident David Bryant knew something was wrong last October when he found Coinbase notifications deleted from his account and his login no longer worked. “I lost about $15,000 dollars worth of crypto,” David said.

A Texas man is suing Coinbase, the cryptocurrency trading platform. The man alleges his Coinbase account was breached to make a $50,000 unauthorized transaction. He says at least 1,000 other Coinbase accounts have also been breached.

- Nearly 75% of Stolen Ransomware Crypto Went to Russia in 2021, New Report Finds | February 15, 2022

A new report finds that Russia was linked to the majority of crypto ransomware invasions, siphoning the equivalent of $400 million in stolen funds to illicit addresses in that country. It appears Russia has strong ties to the majority of crypto hacks and cybercrimes, especially when you consider that 74% of ransomware revenue in 2021 — over $400 million worth of cyptocurrency — went to accounts affiliated with the country in some way, according to a new report from cryptocurrency tracking and analytics firm, Chainalysis.

- Close to $12,000 STOLEN OUT OUT MY COINBASE… I WANT ANSWERS!!! Reddit User | 11 Months Ago

Case #05530638, #05542432. This all happened 4/15/21-4/16/21. How can I talk with someone from coinbase? I am so frustrated that someone stole my Bitcoin, ETH, and transferred $500 from my bank account and stole that too from my coinbase… Total almost $12,000. I am trying to understand what is going on and now I am completely blocked out of coinbase. I want answers!

An increasing number of users of the highly popular cryptocurrency exchange Coinbase have found their accounts on the platform empty after hackers managed to gain access to them and drain their cryptocurrency wallets.

Raza says Coinbase, the cryptocurrency exchange where he was robbed, has not been able to provide a solution and he thinks they need to step up security protocols.

In four minutes, cyber looters pilfered $34,123 worth of virtual currency from a Virginia resident’s Coinbase (COIN) account, the 38-year-old told Yahoo Finance.

- Coinbase hacked in the middle of the night $60k stolen. What should I do? Reddit | January, 2021

I received several txts last night sending me a 2fa code. I woke up and my bitcoin was transferred at 230am to some address. Any idea what happened? Was it my cell phone provider? Seems fishy to me since I could not detect any threats my phone. No idea how the culprit read my txt messages but oh well.

- All of My Crypto Was Stolen! On Coinbase | Reddit User | 8 Months Ago

I am an active user of CoinBase and somehow my account was breached even with 2FA enabled. The hackers stole all of the coins in my account by converting them to BTC and sending them to their wallet. They then deposited $1k USD and purchased BTC using my debit card and stole it before I could lock my account down.

- CoinBase Account Hacked – $23k Stolen and NO HELP from CoinBase | Reddit User | March 15 – 7 months

Taking my case to reddit. My account was hacked approximately 3 weeks ago and .50 BTC (approximately $23k USD) was stolen from my account. In summary, I decided to log into my account one day to check in on the balance. A hacker had locked my account out.

…hackers managed to get into the accounts and move funds off the platform, draining some accounts dry. Thousands of customers had already begun to complain to Coinbase that funds had vanished from their accounts…Coinbase did not disclose how much cryptocurrency was stolen in the attack.

- Coinbase slammed for what users say is terrible customer service after hackers drain their accounts | CNBC | August 24, 2021

CNBC interviewed Coinbase users across the country. The interviews and complaints revealed a pattern of account takeovers, where users see money suddenly vanish from their account, followed by poor customer service from the company. Since 2016, Coinbase users have filed more than 11,000 complaints against Coinbase with the Federal Trade Commission and Consumer Financial Protection Bureau, mostly related to customer service.

- Coinbase customers up in arms after hackers drain crypto wallets | August 26, 2021

An increasing number of users of the highly popular cryptocurrency exchange Coinbase have found their accounts on the platform empty after hackers managed to gain access to them and drain their cryptocurrency wallets.

Loads of scams out there. Remember Coinbase does not support chat. You will never speak with a Coinbase employee.

I have been trying to contact Coinbase support since Thursday when I saw $25k BTC sold from my wallet without my consent and could not receive any assistance at all from Coinbase to protect my investment.

- A string of thefts hit Bitcoin’s most reputable wallet service | The Verge | February 7, 2014

It was 10.6 bitcoins held in the wallet service Coinbase, the most well-funded and widely implemented service on the market.

- Coinbase is mistakenly draining customers’ bank accounts, and people are freaked | Mashable | February 15, 2018

All your money is gone. Whoops! Sorry for your loss. Some Coinbase account holders are losing their shit today as they look to their bank statements to find that the exchange has withdrawn excessive amounts of money from their accounts.

California-headquartered crypto trading platform Coinbase—has been named in at least 115 complaints sent to the U.S. Securities and Exchange Commission and the California Department of Business Oversight

“I believe Coinbase has engaged in fraud by knowingly marketing a service it knows it cannot actually provide,” the filing from November last year read, adding: “Coinbase knows it does not have the infrastructure to timely and adequately meet customer needs.” At the time, bitcoin and other virtual currencies were rocketing in value, leading to an unprecedented interest from eager new investors

- T-Mobile Sued Again Over SIM Swap Crypto Losses | Law Street |

Yesterday, Kevin Frye filed a complaint in the Southern District of Florida against T-Mobile USA, Inc. for allegedly conducting a “SIM-Swap” without his consent, resulting in the loss of tens of thousands of dollars worth of cryptocurrency. The plaintiff claimed that “T-Mobile Representatives were either complicit with the theft or grossly negligent” since they have been on “notice for years that their security measures were not adequate.”

- SIM swapping victim alleges T-Mobile failed to stop $20,000 cryptocurrency scam | Cyberscoop | June 4, 2021

A Pennsylvania woman who lost the equivalent of $20,000 in cryptocurrency as part of a mobile fraud scheme says T-Mobile failed to protect her account in the face of a wave of similar incidents.

Nine months before scammers stole $20,000 from Kesler’s Coinbase account, the suit argues, Jack Dorsey was the victim of another high profile SIM swap, in which outsiders seized control of the Twitter CEO’s information. Security journalist Brian Krebs also covered the issue in 2018, specifically reporting that a T-Mobile retail store employee was under investigation for making an unauthorized SIM swap.

- Hackers Circle as Individual Investors Pour Cash Into Crypto | The Wall Street Journal | November 21, 2021

Mr. Harris sued T-Mobile in July, alleging the company’s practices didn’t meet federal standards and allowed a hacker to take over his phone number in 2020 and steal bitcoin worth nearly $15,000 at the time, and more now.

T-Mobile declined to comment on the suit but motioned to move the case to arbitration. Like Verizon and AT&T, the company requires arbitration to resolve disputes in its terms of service, often leading to closed-door settlements.

- Massive data breach at T-Mobile lands giant class action in KC federal court | Kansas City Business Journal | January 5, 2022

Hackers stole the personal identification data for millions of past, present and prospective T-Mobile customers, leading to a huge class-action lawsuit.

- Hacker lifts $1 million in cryptocurrency using San Francisco man’s phone number, prosecutors say | CNBC | November 21, 2018

Losing cellphone service is inconvenient. But in some cases, it also might mean you’re getting hacked.

“It’s a whole new wave of crime,” said Erin West, the deputy district attorney of Santa Clara County. “It’s a new way of stealing of money: They target people that they believe to have cryptocurrency,” she told CNBC.

- T-Mobile data breach and SIM-swap scam: How to protect your identity | Cnet | August 22, 2021

Just when you think the massive T-Mobile hack can’t get any worse, on Friday the carrier announced that over 50 million people, including current and former customers as well as prepaid customers, were affected by the breach. Information like Social Security numbers, driver’s licenses and account PINs were exposed.

- Another Bitcoin Investor Sues T-Mobile Over SIM Swap Attack | Coindesk | July 15, 2021

Cellphone carrier T-Mobile is being sued over allegations it failed to safeguard against a SIM swap scam that cost one customer $55,000 in lost.

- T-Mobile Sued Over $8.7M Stolen in SIM-Swap Attacks | Cointelegraph | July 23, 2020

The CEO of a crypto firm that recently settled with the SEC over its 2017 ICO is suing T-Mobile over a series of SIM-swaps that resulted in the loss of $8.7 million worth of crypto.

The suit accuses T-Mobile of having “abjectly failed” in its responsibility to protect the personal and financial information of its customers.

- Crypto Theft Victim Sues T-Mobile for Allowing SIM-Swap Attack | Finance Magnates | February 12, 2021

A victim of a crypto theft using SIM-swap attack has filed a lawsuit against T-Mobile, alleging the failure and negligence on the part of the US cell phone carrier in preventing these scams.

“This action arises out of T-Mobile’s systemic and repeated failures to protect and safeguard its customers’ highly sensitive personal and financial information against common, widely reported, and foreseeable attempts to illegally obtain such information,” the lawsuit alleged.

- T-Mobile being sued by victim of SIM swapping attack | Tmo News | February 11, 2021

T-Mobile is currently facing a complaint against one of the victims of SIM swapping, a type of fraud.

Cheng believed that the attack would not have happened if not for “T-Mobile‘s negligent practices and its repeated failure to adhere to federal and state law.”

- T-Mobile Is Facing Another SIM Swapping Complaint | Android Headlines |

T-Mobile is facing yet another SIM swapping complaint involving cryptocurrency theft. Last week, a Philadelphia man named Richard Harris filed a complaint in the Eastern District of Pennsylvania against the wireless giant alleging he lost approximately $55,000 worth of Bitcoin due to the company’s failure to safeguard his account

The sim was successfully swapped which means that either it was done without the pin or the person knew the pin. Again, this is only possible if it was a T-Mobile employee and most likely one of the employees that help a month prior during the line add and upgrade.

When it comes to security or whatever it is leave T-Mobile. It is insider job someone is doing sim swaps.

- Why you can’t ignore the hackers and data breaches, like one at T-Mobile | Detroit Free Press |

T-Mobile confirmed this week that it was hit by a “highly sophisticated cyberattack” that exposed names, dates of birth, Social Security numbers and driver’s license information for more than 40 million consumers who had applied for credit with T-Mobile.

After a crazy week where T-Mobile handed over my phone number to a hacker twice, I now have my T-Mobile, Google, and Twitter accounts back under my control. However, the weak link in this situation remains and I’m wary of what could happen in the future.

- T-Mobile discloses data breach after SIM swapping attacks | Bleeping Computer |

American telecommunications provider T-Mobile has disclosed a data breach after an unknown number of customers were apparently affected by SIM swap attacks. SIM swap fraud (or SIM hijacking) allows scammers to take control of targets’ phone numbers after porting them using social engineering or after bribing mobile operator employees to a SIM controlled by the fraudsters.

- Fraudulent Sale of My SIM card | T-Community | 2019

Yesterday, someone went into a T-Mobile retail store used a fake California Drivers License to buy a copy of my SIM card.

And now for the crazy chain of events, where T-mobile allowed a complete stranger to do a SIM swap on me, and Coinbase allowed a complete stranger to change my Coinbase identity with no questions asked.

Silver Miller said that “with little more than a persuasive plea for assistance, a willing telecommunications carrier representative, and an electronic impersonation of the victim,” criminals can manage to steal millions of dollars targeting unsuspecting victims.

Hackers swapped my T-Mobile SIM card without my approval and methodically shut down access to most of my accounts and began reaching out to my Facebook friends asking to borrow crypto.

Coinbase has admitted that hackers stole crypto from thousands of its users’ accounts over a three-month period.

Bad actors were able to infiltrate the accounts of and steal cryptocurrency from around 6,000 Coinbase customers by exploiting a multi-factor authentication flaw.

Matthew doesn’t know how the hackers were able to access his Coinbase account, but he remembered that when he signed up with Coinbase, they advertised they had insurance.

- My Binance account got hacked!! | Reddit | 2019

My binance account was hacked a day before. All my funds were converted into ETC and withdrawn from binance. I received no confirmation mail for withdrawals too. All security steps – login password, 2FA, confirmation mail were compromised.

- My Binance account got hacked | Bitcointalk | February 12, 2021

I don’t know how people can do this? I used strong password and also use all security option but no result this bloody f**king person got access my account.

- My Binance account was HACKED and DRAINED! | Steemit | 2018

The world’s crypto market turned red as rumours about Binance, the world’s most traded cryptocurrencies exchange, being hacked began circulating on the web yesterday morning. Some users reported that their alts on Binance were “market sold” at a loss and balances drained.

Yesterday, BeanThe5th made a thread in the popular /r/cryptocurrency subreddit, regarding a theft that has occurred on his or her Binance account. Many users who saw this Reddit thread were quite surprised, as it has become common knowledge that Binance is one of the most reputable and secure exchanges that exist.

- Binance Hit By $570 Million Blockchain Bridge Hack | Investopedia | October 07, 2022

Hackers have stolen $570 million from a blockchain linked with Binance. The largest crypto exchange has had to temporarily halt the operation of its Binance Smart Chain after the exploit.1 Since the hack, Binance Coin’s (BNB) price has also dropped noticeably, with the token down 3.5% in the last 24 hours. At the time of writing, it is trading at $281.

- If bitcoin is so safe, why does it keep getting hacked? | Vox | May 9, 2019

Hackers just stole $40 million worth of bitcoin from Binance, one of the largest cryptocurrency exchanges in the world. It’s hardly the first time crypto has been targeted by thieves. For a technology that’s supposed to be hyper secure, in practice, it’s often proven itself to be, well, not.

- Binance investigates hack affecting a number of crypto tokens | CNN | December 2, 2022

Binance, the world’s biggest cryptocurrency exchange, is investigating a hacking incident that affected a number of crypto tokens Friday. According to its founder and CEO Changpeng Zhao, a private key, used to encrypt or decrypt data, had been hacked.

“Initial analysis is developer private key was hacked, and the hacker updated the smart contract to a more malicious one,” Zhao said on Twitter, adding that the Ankr and Hay tokens were affected.

- Binance Hack Steals $41 Million From ‘Hot Wallet’ | Security Intelligence | May 13, 2019

On Tuesday, May 7, Binance, the world’s largest cryptocurrency exchange, announced that malicious actors had compromised user application programming interface (API) keys and two-factor authentication (2FA) codes, enabling them to access the company’s hot wallet and steal more than 7,000 bitcoin (BTC).

- $570 million worth of Binance’s BNB token stolen in another major crypto hack | CNBC | October 7, 2022

Cryptocurrency exchange Binance temporarily suspended its blockchain network after hackers made off with around $570 million worth of its BNB token.

- My Binance Account with $50k has been Hacked, Please Help Me | Reddit | 2018

Hello, I have been impersonated and sim swapped, they hacked my emails, twitter, facebook, exchanges, literally everything including binance, which they stole 2 btc (daily limit) from today and will steal more if the account isn’t frozen by tomorrow. They logged in and somehow disabled my google authenticator and I cannot get into my account, microsoft is working on giving me the hacked email back that is related to binance but they say it will take 3 days to escalate the ticket. In 3 days the hackers will have already taken my entire balance so I really need the binance account frozen now before they can steal more.

- Binance Account Hacked! With 2FA on. $20,000 | Reddit | 2022

My account was compromised with multiple security layers on it. Google 2FA and Email Authentication which i both had on it. My google 2FA was on a device only for my google authentication apps, I take necessary steps to prevent hacks & The crazy thing is i always receive emails when anything is changing or so on so when the hack was happening binance did not not alert my email or anything. All my securities was reset and email was changed.

- I got HACKED | Reddit | 2022

Someone made a withdrawal on my Binance account when I was sleeping last night and took all my money away. My Binance account had 2FA on and everything was safe and secure but somehow the hacker managed to hack it and withdrew all my holdings out. Binance support does not have a hacked feature, so it’s pissing me off. Is there anyway that I can get it back? This is all my life savings.

- Gemini Security Failures to Blame for Crypto Hack, IRA Suit Says | Bloomberg Law | June 6, 2022

Crypto exchange Gemini Trust Co. lacked proper safeguards that resulted in retirement-account holders losing around $36 million in Bitcoin and Ether when the master key got hacked, IRA Financial Trust said in a new lawsuit.

- Compromised Data Of 5.7M Gemini Crypto Exchange Users Given Away On Hacking Forums | Hot Hardware | December 16, 2022

Then, on Tuesday of this this week, someone posted the entire stolen database for free on Breach Forums. It’s unclear whether this individual previously attempted to sell the database but was unsuccessful, covertly purchased it, or otherwise obtained it through some other means. We also still don’t know when the data breach occurred, though the second post attempting to sell the database claimed it was obtained in September.

Regardless, the personal information of Gemini’s 5.7 million customers is now publicly available online.

- Hacker lifts $1 million in cryptocurrency using San Francisco man’s phone number, prosecutors say | CNBC | November 21, 2018

San Francisco resident Robert Ross, a father of two, noticed his phone suddenly lose its signal on Oct. 26. Confused, he went to a nearby Apple store and later contacted his service provider, AT&T. But he wasn’t quick enough to stop a hacker from draining $500,000 from two separate accounts he had at Coinbase and Gemini, according to Santa Clara officials.

- Account Hacked – No support from Gemini | Reddit | 2021

My account on Gemini was hacked. My password and email address on Gemini were both changed. I have been trading on Gemini for 4 years. Gemini now claims that there is no account at Gemini with my email. I have a ton of USD in my Gemini account and they will not even confirm that the funds are frozen.