Legal Guide to Buying US Real Estate with Bitcoin

Real estate sellers, developers, and their brokers should consider an alternative approach for marketing and selling properties in the US to local and international buyers. This approach involves closing real estate transactions using Bitcoin and other main types of cryptocurrency.

Some of the real estate brokerage firms in New York have started slowly embracing the notion of selling their clients’ properties for Bitcoin or other virtual currencies (also commonly referred to as “digital currencies,” “cryptocurrencies” or “crypto”).

This article will focus on Bitcoin one of the most widespread virtual currencies. Bitcoin is well-embraced by regulators, which allows for a high degree of its transferability in domestic and cross-border transactions.

However, what most real estate market participants don’t realize is that every single real estate listing in the US could be purchased with Bitcoin. This, of course, requires proper structuring and knowledgeable intermediaries, including attorneys, exchanges, banks, and/or custodians.

When structuring a real estate purchase using Bitcoin (or any other virtual currency), the parties involved in a transaction must take into consideration, among other factors, tax and escrow complications for accepting payments in Bitcoin, know your client (KYC)/anti-money laundering (AML) checks on the purchaser and the purchaser’s digital wallet.

There have also been a lot of misconceptions surrounding the use and regulations of Bitcoin in the US and abroad. We will analyze and debunk some of the common myths, like the ones that Bitcoin payments are untraceable and used mainly for illegal activities or that Bitcoin is not regulated in the US.

On the bright side, with proper legal and tax structuring, making real estate listings available to buyers interested in paying with Bitcoin presents an intriguing opportunity for sellers and their real estate agents. Bitcoin has become a major market for investors and virtual currency miners around the world. For example, much of the world’s supply of Bitcoin are held by investors and miners from China, the United States, Japan, Czech Republic, Russia, Iceland, Georgia, and Canada.

Given the volatile nature of virtual currencies such as Bitcoin, many investors and miners prefer to diversify their Bitcoin holdings, either by investing in precious metals or US real estate.

In addition, real estate transactions involving Bitcoin may be structured and closed efficiently—often faster than all-dollar transactions—especially if a real estate transaction involves a foreign buyer.

This article discusses and compares two general ways of structuring a real estate transaction in the US involving Bitcoin as a payment method – all-Bitcoin real estate transaction and Bitcoin-USD transaction.

The first option of an all-Bitcoin transaction involves a number of extra risks and hurdles associated with the current legal and tax status of Bitcoin. It also requires a seller to agree to accept Bitcoin as a form of payment for the tendered real estate. Such a method can be attractive if crypto enthusiasts happen to be on both sides of a real estate transaction.

The second option, however, allows the holder of Bitcoin to purchase any real estate listing in the US, provided that the holder can pass requisite due diligence. Such an option is modeled very closely to a traditional USD (a/k/a “fiat”) real estate transaction making it attractive to all sellers, and both local and international buyers with digital assets.

Before analyzing each option, we will discuss some of the most common misconceptions surrounding Bitcoin.

Common Myths Surrounding Bitcoin

Myth # 1 – Bitcoin transactions are anonymous, untraceable and are mostly used for money laundering and as means of financing illegal activities

It is a myth that Bitcoin transactions are untraceable. In fact, cash – not virtual currencies – is the most intrinsically private means of transacting [1].

According to Jason Weinstein, a former federal prosecutor and Deputy Assistant General in the Department of Justice’s Criminal Division:

Bitcoin and the blockchain provide significant advantages for law enforcement…The most obvious is that the blockchain allows one to trace all transactions involving a given bitcoin address, all the way back to the first transaction. That gives law enforcement the records it needs to ‘follow the money’ in a way that would never be possible with cash… [2]

Mr. Weinstein goes even further safely comparing a Bitcoin wallet to a conventional bank account in terms of traceability:

a bitcoin address is essentially about as anonymous as a bank account number…even if you don’t use an exchange to obtain bitcoins you’re still not truly anonymous, because there are techniques available to help link users to their addresses[3]

In the past, federal prosecutors have used public blockchain to track illegal transactions and connect them with perpetrators. [4]

Similarly, addressing Bitcoin’s traceability and aptness for criminal activities in response to the Senate Homeland Security Committee’s inquiry into digital currencies, Edward Lowery III, Special Agent in Charge of Criminal Investigative Division of the U.S. Secret Service, stated:

The public ledger feature of the Bitcoin blockchain differentiates Bitcoin, and other decentralized digital currencies, from many of the centralized digital currencies, such as e-gold and Liberty Reserve. The blockchain makes it harder for criminals to hide their illicit activity. The work of researchers to link known transactions to individual identities reduces the attractiveness of Bitcoin for criminal activities. This research also provides an additional tool for law enforcement to identify illicit transactions, assets and the individuals associated with this activity in support of apprehension, asset forfeiture, and prosecution[5]

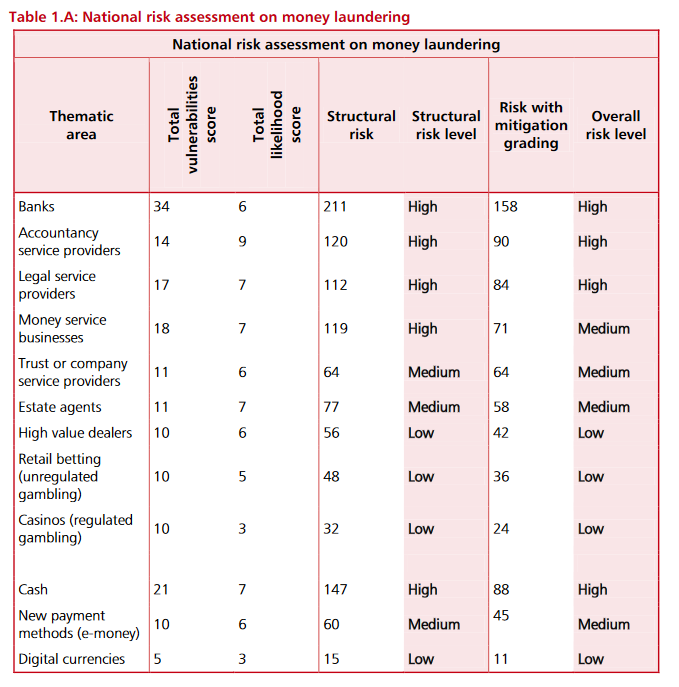

In the National Risk Assessment of Money Laundering and Terrorist Financing Report, the UK Government determined that digital currencies pose the lowest risks for money laundering and terrorist financing. Quite to the opposite, Cash, banks, accountants, lawyers, and other professional service providers pose the highest risk for money laundering [6].

Please refer to the following table summarizing the findings of the UK Treasury:

Myth # 2 – Bitcoin is not regulated in the US

In the US, Bitcoin and transactions involving Bitcoin are regulated by:

- Financial Crimes Enforcement Network (“FinCen”);

- US Office of Foreign Assets Control (“OFAC”);

- Commodity Futures Trading Commission (“CFTC”);

- Internal Revenue Service (“IRS”);

- Individual states

FINCEN

The FinCen collects and analyzes information about financial transactions to combat domestic and international money laundering. The organization has been regulating virtual currencies and related activities since 2011.

FinCEN’s rules apply to all transactions involving money transmission – including the acceptance and transmission of virtual currency.

In 2013, FinCen issued guidance confirming that Bitcoin exchanges and payment processors are financial institutions under the Bank Secrecy Act (BSA) and thus are subject to the BSA and FinCen implementing regulations, including stringent AML rules.[7] Any virtual currency transactions exceeding $10,000 must be reported to FinCEN.

OFAC

OFAC is a financial intelligence and enforcement agency of the US Treasury Department responsible for administering and enforcing economic and trade sanctions in support of U.S. national security.

OFAC treats virtual currencies the same as fiat currencies (USD) when it comes to Specially Designated Nationals – a list of people affiliated with sanctioned individuals, organizations and governments.

Under OFAC, US persons are obligated to comply with sanctions obligations in transactions involving virtual currencies.

CFTC

The CFTC is an independent federal agency that regulates futures and options markets. The goal of the CFTC is to protect financial markets from fraud, manipulation, and abusive practices.

The CFTC first determined that virtual currencies like Bitcoin are commodities in 2015. CFTC has the power to prosecute fraud related to Bitcoin transactions.

IRS

For federal tax purposes, a virtual currency like Bitcoin is property. General tax principles applicable to property transactions apply to transactions using virtual currency.

A taxpayer who receives virtual currency as payment for goods or services must, in computing gross income, include the fair market value of the virtual currency, measured in US dollars, as of the date that the virtual currency was received.

Individual States

Additionally, each of the 50 states regulates the use of the virtual currencies. There are several regulatory tools that states use to supervise the use of virtual currency. These include licensing requirements and money transmission laws.

Real Estate Transactions Using Bitcoin

The following table summarizes the main features of the 2 approaches to a real estate transaction using Bitcoin: all-Bitcoin transaction and Bitcoin-USD Transaction, as compared to a traditional USD transaction in the third column:

|

Feature of a Real Estate Transaction |

All-Bitcoin Transaction |

Bitcoin-USD Transaction |

USD Transaction |

|

Settlement time |

Minimal |

Possible within 1-2 business days |

Up to 14 business days (depending on the country) |

|

Price volatility risk |

High |

Minimal |

Minimal |

|

Contract default risk |

High – due to crypto price volatility |

Minimal |

Minimal |

|

U.S. income tax liability for converting crypto – U.S. buyers |

Exists: buyer needs to realize gain on the disposed crypto, as it is considered property |

Exists: buyer needs to realize gain on the disposed crypto, as it is considered property |

None |

|

U.S. income tax liability for converting crypto – foreign buyers |

None |

None |

None |

|

Escrow of down payment |

Only some escrow agents accept crypto |

Accepted by all escrow agents |

Accepted by all escrow agents |

|

Transaction fee |

Minimal |

1-2% conversion fee (Depending on the exchange and provider) |

Minimal |

|

1031 Exchange |

Unsuitable |

Suitable |

Suitable |

|

KYC/AML check |

Performed by seller (recommended) |

Performed by bank or third-party service |

Performed by bank |

Option 1: All-Bitcoin Real Estate Transaction –Cumbersome for Traditional Sellers Who Do Not Want to Own Crypto

In an all-Bitcoin real estate purchase transaction, a purchaser transfers a Bitcoin payment from his/her digital wallet to a seller’s digital wallet and/or digital wallet(s) of the seller’s representatives, including an attorney, title company, and/or escrow agent.

At least at this early development stage of virtual currencies, it is going to be challenging from the legal and tax perspective (but certainly doable) for the seller and seller’s representatives to process a real estate transaction that involves a full purchase price payment in Bitcoin.

KYC/AML Check

As no bank or financial institution is typically involved in an all-Bitcoin real estate transaction, the seller or sellers’ legal representatives must perform KYC/AML checks on a prospective purchaser (including AML check on the purchaser’s Bitcoin wallet). This is necessary to make sure that the “title” of the purchaser’s Bitcoin is clean and that the purchaser’s name does not appear on any of the sanction lists, including SDN, OFAC and PEP lists. Services like the IdentityMind platform offers flexible KYC / AML compliance solutions.

It would be highly undesirable for the seller to accept Bitcoin for his/her million-dollar property in New York and later find out that the Bitcoin’s title is tainted, e.g., Bitcoin transfer was sent from a digital wallet that was added to OFAC’s Bitcoin blacklist. No title insurance company would insure a seller against these risks. Proper due-diligence is a must.

Escrow Issues

When a buyer and seller execute a contract of sale, the buyer generally pays 5% to 10% of the purchase price as a down payment. The seller does not receive those funds immediately. Rather, they are held in escrow by a title company or attorney until closing.

In New York, for example, any person who stores, holds or maintains custody or control of virtual currency on behalf of others must obtain a BitLicense. Applying for a BitLicense is a highly complex and expensive undertaking.

The statutory language does not expressly exclude licensed New York attorneys from the BitLicense requirement.

In addition to uncertainly with the BitLicense requirement in New York, today most title companies and lawyers may not want to hold another person’s virtual currency for both legal and security reasons. The issue of custody, or how to safely store digital assets, has kept institutional investors on the sidelines.

There are several out-of-state trust companies that provide escrow solutions for storing digital assets. Before enlisting the services of an out-of-state escrow agent, it is important to understand, among other things, the process the company uses to store digital assets (“cold” vs. “hot storage”) and if the company is insured against loss and theft of virtual currency in the event of cyber-attacks.

Price Volatility

This volatility makes it impossible to know at the time a contract of sale is signed how much a Bitcoin will be worth at closing. As a result, it would generally be imprudent for a buyer, agent, or others to commit to a fixed amount of crypto as payment.

The parties to a sale could try to avoid this problem by closing immediately (or promptly after the contract of sale), which may be problematic for properties requiring extensive due diligence or approval periods.

However, if a buyer and seller are insisting on specifying the contract price in Bitcoin or tying the price to the Bitcoin exchange rate at the date of the contract, it may be critical to include a clause to address potential fluctuations in the price of Bitcoin between the contract and closing dates.

Tax Issues

Taxable gains from exchanging Bitcoin for real estate. In most real estate transactions, a seller anticipates that he or she will have to pay income taxes on any gain realized from the sale. But in an all-Bitcoin transaction, if a buyer is a U.S. tax resident, he/she must also be prepared to pay income tax as a result of the transaction.

In an all-Bitcoin real estate transaction, both buyer and seller may face undesired tax consequences. As a result, either party may be unwilling or unable to enter such a sale. Below are some examples.

The IRS treats virtual currencies like Bitcoin as personal property. That is, the sale of real property for Bitcoin is not a sale of property for money, but an exchange of one type of property (Bitcoin or another cryptocurrency) for another (real estate).

In such exchanges, both buyer and seller must pay income taxes to the extent the fair market value of the property received exceeds their adjusted basis in the property surrendered. In other words, the buyer may have to pay income tax even though he or she never exchanged his or her Bitcoin for dollars, and so never had “income” in the sense most people think of.

Inability to qualify for a 1031 exchange. An all-Bitcoin transaction may also prevent a seller from deferring recognition of gain in a 1031 like-kind exchange. These are often structured as “deferred exchanges,” in which the purchase price is not delivered to the seller but held in escrow until the seller closes on a new property of like kind.

But, as discussed earlier, very few (if at all) 1031-exchange qualified intermediaries may be willing or know how to hold virtual currency in escrow, meaning that it may be impossible for a seller to complete such an exchange to satisfy the requirements for IRC Section 1031.

In that event, the seller will have to recognize any gain from the sale of the property. This complication makes it almost impossible for any seller interested in a 1031 exchange to accept cryptocurrency as payment.

Transfer Taxes and Title Insurance. Other tax issues may further complicate an all-Bitcoin transaction, including liability for transfer taxes (such as the Real Property Transfer Tax in New York State and New York City, as well as NYC’s “mansion tax”) and federal and state withholding taxes if a transaction involves a non-US-resident seller, which must be paid strictly in USD.

Option 2: Bitcoin-USD Real Estate Transaction – Efficient Alternative for All Sellers and Buyers

Sellers unwilling to accept Bitcoin for their real property can request a buyer to convert his or her Bitcoin to dollars that in turn would be used to cover the purchase price down payment, remaining closing balance, and expenses, including title insurance premiums and transfer taxes.

If a buyer is from the US, he/she can convert Bitcoin to dollars using a licensed payment processor like Coinbase. For example, a buyer’s Coinbase account would be connected to the buyer’s bank account in the US. The US dollar proceeds from the sale of Bitcoin would be deposited in such a buyer’s bank account.

If a buyer is not from the US, it can be challenging to open a bank account in the US to convert the buyer’s Bitcoin holdings to dollars.

However, attorneys who can complete proper due diligence on the buyer and, more importantly, the buyer’s digital wallet and the source of Bitcoin, can facilitate the transfer of Bitcoin into US dollars through Coinbase.

Conclusion

Offering to accept Bitcoin as payment may provide sellers with an advantage among investors with substantial Bitcoin holdings and a desire to move those holdings into real estate.

Engaging in such offerings will require the seller and his or her representatives to understand the options of executing real estate transactions using Bitcoin and the various methods for converting Bitcoin into USD.

With such an understanding, plus appropriate legal and tax planning, sellers can set their listings apart and attract purchases using the billions of dollars currently held in Bitcoin.

This article is provided for your convenience and does not constitute legal advice. The information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations. Prior results do not guarantee a similar outcome.

Reference List

[1] Adam Ludwin, How Anonymous is Bitcoin?, Coin Center, Jan. 20, 2015 available at https://coincenter.org/entry/how-anonymous-is-bitcoin

[2] Jason Weinstein, How can law enforcement leverage the blockchain in investigations?, Coin Center, May 12, 2015, available at http://coincenter.org/entry/ how-can-law-enforcement-leverage- the-blockchain-in-investigations

[3] Jason Weinstein, How can law enforcement leverage the blockchain in investigations?, Coin Center, May 12, 2015, available at http://coincenter.org/entry/ how-can-law-enforcement-leverage- the-blockchain-in-investigations

[4] Jerry Brtio, Comments to the Federal Elections Commission on Technological Modernization, December 2, 2016, http://sers.fec.gov/fosers/showpdf.htm?docid=353998

[5] Hearing Before the Senate Homeland Security and Governmental Affairs Committee, Beyond Silk Road: Potential Risks, Threats, and Promises of Virtual Currencies, Nov. 18, 2013, available at https://www.gpo.gov/fdsys/pkg/CHRG-113shrg86636/pdf/CHRG-113shrg86636.pdf – quoting Jerry Brito

[6] HM Treasury, UK national risk assessment of money laundering and terrorist financing, October 2015, available at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/468210/UK_NRA_October_2015_final_web.pdf

[7] FinCen, Applications of FinCEN’s Regulations to Persons Administering, Exchanging or Using Virtual Currencies, Mar., 18, 2013, available at https://www.fincen.gov/resources/statutes-regulations/guidance/application-fincens-regulations-persons-administering

Extra Resources:

- Regulation of Cryptocurrency Around the World

- Treatment of Bitcoin Under US Property Law

- Bitcoin Survey – Library of Congress

- Virtual Currencies

- The Rise of Bitcoin – Understanding the Ins and Outs of this Cryptocurrency

- Economic and Non-Economic Trading in Bitcoin

- Bitcoin and Virtual Currency Regulation

- Bitcoin: Technical Background and Data Analysis

- Bitcoin Dealers Licensed as Money Transmitters

- The Rise of Crypto: Could Bitcoin Reach $12,000 by 2020

- Bitcoin: Peer-to-Peer Electronic Cash System

- Is it Ethical for Lawyers to Accept Bitcoins and Other Cryptocurrencies?

- Exploring the Opportunities and Challenges Surrounding the Cryptocurrency and Blockchain Ecosystem

- Investor Advisory: Bitcoin & Other Virtual Currencies

- Bitcoin Pricing, Adoption and Usage: Theory and Evidence

- How Bitcoin Functions as Property Law

- IRS Guide to Bitcoin and Cryptocurrency

- Rise of Crypto: Could Bitcoin Reach $12,000 by 2020?

- Currency, Legal Tender & Bitcoins

- Bitcoin: Technical Background and Data Analysis

- Beyond Silk Road: Potential Risks, Threats, and Promises of Virtual Currencies

- Future of Cryptocurrency: Countering Fraud and Regulating Digital Assets

- Storing and Querying Bitcoin Blockchain Using SQL Databases

- Hearing Before the Senate Homeland Security and Governmental Affairs Committee, Beyond Silk Road: Potential Risks, Threats, and Promises of Virtual Currencies

- Acting Manhattan U.S. Attorney Announces Extradition Of Co-Founder Of Global Cryptocurrency Ponzi Scheme