65+ Top Real Estate Tokenization Questions

Tokenization represents real estate ownership with virtual tokens on a blockchain, offering benefits such as liquidity, transparency, and security. However, the process is complex both technically and legally.

Our team compiled a list of over 65 common issues and questions regarding real estate tokenization to consider before launching a real-estate-backed virtual token.

Initial Planning Considerations

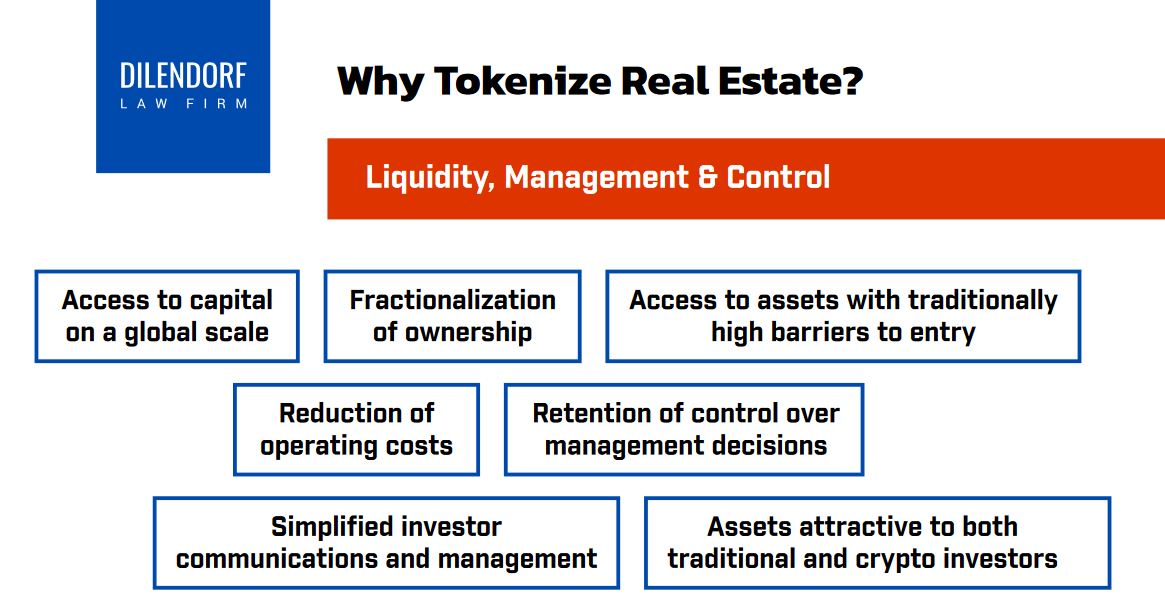

1) What are the benefits of tokenizing real estate assets?

2) What strategies can be used to attract individual investors from the U.S. and other countries to a security token offering?

3) What are the misconceptions surrounding the use of NFTs and DAOs in real estate tokenization?

4) What are the restrictions on trading real estate security tokens on centralized or decentralized cryptocurrency exchanges such as Uniswap, Coinbase, and Binance?

5) What are some common pitfalls to avoid when launching a security token offering in the U.S. and globally?

6) How do you select a broker-dealer, transfer agent, technology platform, advisors, and SEC-regulated Alternative Trading System (“ATS”) in the tokenization process?

Legal

7) How can token price be calculated effectively?

8) How can the number of tokens offered be determined?

9) When is it preferable to establish an onshore or offshore corporate/tax structure for tokenizing U.S. real estate?

10) What is the procedure for tokenizing company shares that possess real estate?

11) What factors should be considered when transferring real estate from a holding company to a special purpose vehicle (SPV) and tokenizing SPV shares?

12) What are the significant considerations for tokenizing real estate with a mortgage?

13) What factors should be considered when designing token holder rights, such as voting rights, redemptions, and mandatory buyout provisions?

14) When should a client consider launching a tokenized 3(c)(5) real estate fund?

15) What are the legal considerations for managing the realization buyback if one of the portfolio properties is sold?

16) How should the US dollar conversion rate be structured if investors subscribe to the offering using Bitcoin, Ethereum, or other cryptocurrencies?

17)Which international jurisdictions prohibit the sale of tokenized securities?

18) What are the marketing restrictions for selling tokenized securities in Singapore, Hong Kong, Japan, Malaysia, Spain, France, Italy, and Germany?

Tax

19) How are real estate security tokens taxed?

20) What are the capital gains tax implications of tokenizing an existing real estate portfolio?

21) What are the challenges when tokenizing US real estate owned by an LLC?

22) What tax considerations are involved in launching an onshore or offshore tokenized real estate fund?

23) How can FIRPTA tax withholdings be efficiently planned for offerings involving non-US token holders?

24) What are the potential legal and tax consequences of tokenizing an income-generating property?

25) How can tax compliance documents be issued to US and non-US token holders?

Business

26) What are the key factors to consider when deciding between tokenizing an existing real estate portfolio or fundraising for a targeted acquisition?

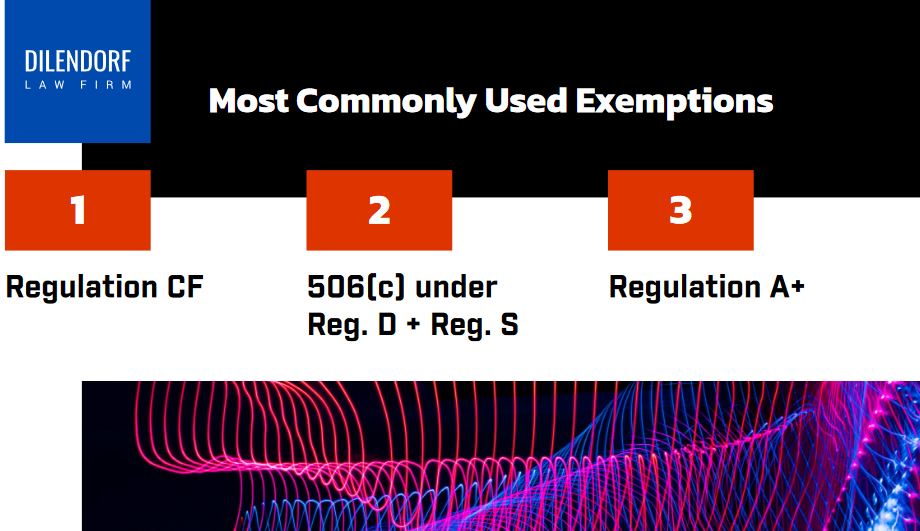

27) What are the fundraising limits for security token offerings under Reg CF, Reg D/S, or Reg A+ exemptions from SEC registration?

28) Which types of real estate interests can be tokenized, such as the underlying asset, real estate fund, or equity in a legal entity that owns a real estate asset?

29) How soon after minting can a client list newly created real estate security tokens for secondary market trading on an ATS platform?

30) What is the process for fractionalizing a portion of an existing income-generating real estate portfolio?

31) What are the standard industry practices for developing an investor/pitch deck, business plan, and financials when launching a security token offering?

32) What are the restrictions on marketing tokenized securities to accredited and non-accredited investors in the US?

Primary Issuance and Investor Onboarding

33) What are the best practices for investor onboarding in a security token offering?

34) In a security token offering, what are the key business and legal terms to negotiate with the token-issuing platform when minting security tokens and onboarding investors?

35) What are the steps involved in accepting crypto investments in a security token offering?

36) How can a client convert cryptocurrency investments to USD during a security token offering?

37) Which banks and custodians should a client consider using for a security token offering?

38) What are the necessary KYC, AML, and accreditation checks for U.S. and non-US investors to participate in a security token offering?

39) How can a client optimize technology and licensing costs when launching a security token offering?

40) What is the process for distributing security tokens to investors’ wallets during a security token offering

Technology

41) Should a client launch their own real estate tokenization platform or use an existing technology provider? How long does it take to launch the platform?

42) Which blockchain should a client use for minting security tokens, such as Ethereum, Avalanche, Algorand, Matic, Tezos, or others?

43) Why should a company rely on industry-certified security token standards instead of creating its own tokens when issuing security tokens?

44) What are the gas fees associated with issuing security tokens?

45) Which blockchains are not compatible with Regulation D/S offerings?

46) What is the process for managing lost or destroyed security tokens?

47) How should token security considerations be handled in the event of a blockchain bug, denial-of-service attack, consensus-based attack, or other security threats?

Securities Regulations

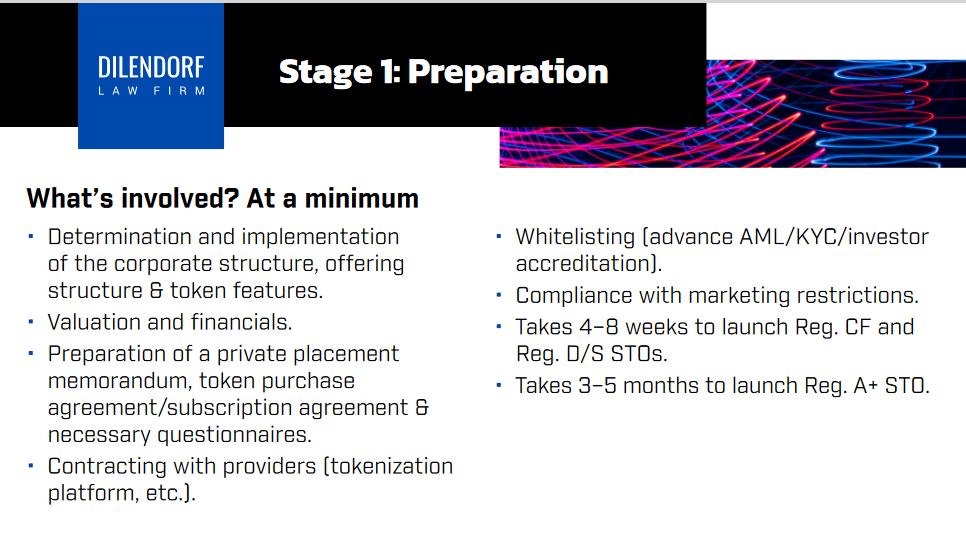

48) What is the process for launching a security token offering under Reg. D/S & CF+ exemptions, and what are the key requirements to meet these exemptions?

49) Can a U.S.-based token issuer sell its securities outside of the United States? Conversely, can a foreign security token issuer sell its securities in the U.S., and what are the regulations that govern such sales?

50) What are the limitations and restrictions on trading Reg D & Reg CF securities on secondary marketplaces, and how can a client navigate these limitations?

51) What are the restrictions on the number of investors in a tokenized offering under Reg. D/S & CF exemptions, and what are some strategies for managing investor limits?

52) How can the Reg. CF exemption be an attractive framework for real estate developers looking to raise up to $30M+ in capital, and what are the key benefits and limitations of this exemption?

53) What is the process for automating compliance via smart contracts, and how can a client use smart contracts to ensure compliance with jurisdictional restrictions?

54) Can a client fundraise for its tokenized real estate project without hiring a broker-dealer, and what are the potential advantages and disadvantages of this approach?

55) What are some key considerations when selecting a broker-dealer for a client’s tokenized project in different regions, such as the U.S., Europe, Asia, and the Middle East?

Secondary Market Trading

56) What are the requirements for listing a security token offering on ATS platforms for secondary market trading?

57) Which ATS platforms are available for companies to list their security tokens for secondary trading in the U.S., Europe, and Asia?

58) What are the key business and legal terms that a company must negotiate with an ATS platform and a broker-dealer before placing its security token offering on the secondary market for trading in the U.S. and abroad?

59) What are the industry challenges for cross-listing security tokens on U.S. and international ATS platforms?

60) What are the legal, tax, and business considerations for managing a security token offering during secondary market trading?

61) What are the timelines, processes, and fees for registering an ATS platform in the U.S. for trading security tokens?

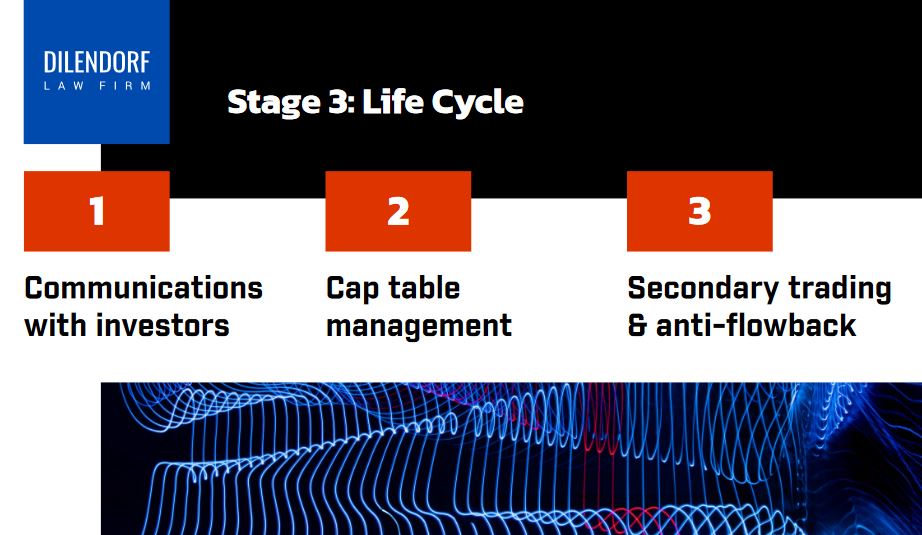

Post-Issuance Considerations

62) How can a company effectively manage the lifecycle of security tokens, including distributions, voting, and investor engagement in real-time?

63) What steps should a company take to ensure effective management of a security token cap table in compliance with Rule 144 for reselling restricted or controlled securities?

64) What is the process for burning tokenized shares and managing distribution/payout for redeemed tokens?

65) What factors should a company consider when deciding to burn investors’ tokens if a piece of property is sold from the tokenized real estate portfolio?

DLF’s Real Estate Tokenization Brochure

Resources

- Tokenized Security & Commercial Real Estate

- Tokenized Real Estate: Creating New Investing and Financing Channels Through Blockchains

- Fluidity: Tokenization of Real Estate Assets

- Tokenization of Assets – Research Papers

- Arizona Department of Real Estate – Statement on Real Estate Tokenization

- Letter Regarding Real Estate Tokenization to Wyoming Blockchain Legislative

- Real Estate, Vehicles, and Parts, Insurance on Blockchain

- SEC Offering Statement for Real Estate Tokenization Project – PropertyClub, Inc

- Tokenization of Assets is Disrupting the Financial Industry

- Token Taxonomy Acy of 2019

- Regulatory Approaches to Cryptoassets – Library of Congress

- Real Estate Digitization

- Regulation CF Crowfunding for Tokenizing Real Estate

- Regulation Crowfunding, General Rules and Regulations

- Crowfunding for Investors – Updated Investor Bulletin

- Regulation A+ Offering for Real Estate

- Updated Investor Bulletin: Regulation A

Read More