Venture Capital Funds

Whether certain venture capital fund activities require registration of the offering of securities, broker-dealer registration, investment company registration, or investment adviser registration is a fact-specific analysis that must be conducted on a case-by-case basis.

Are interests in private venture capital funds “Securities”?

All offers, sales, and issuance of securities are governed by federal securities rules and regulations.

Under federal and state laws, securities are defined broadly to include shares of limited partnership interests and membership interests in an LLC, LLP and investment contracts.

Interests in a private venture capital fund offered and sold to investors will typically constitute securities within the meaning of federal and state laws.

As a result, venture capital funds must comply with all applicable regulations of the Securities and Exchange Commission (“SEC”) and the securities regulators in the states where a venture capital fund operates. This includes being aware of, and complying with, applicable provisions such as the registration and anti-fraud provisions of federal and state securities laws.

Are venture capital fund offerings required to be registered with the SEC Commission and the states or are exemptions from registration available?

Under the federal Securities Act of 1933 (Securities Act), all offers and sales of securities must be either (1) registered with the SEC or (2) conducted in compliance with an exemption from registration. State securities laws also require registration or an exemption from registration before securities may be offered or sold in the state.

Securities regulators interpret broadly the meaning of the term “offer.” For example, advertising a business opportunity could be considered an offer; therefore, it is prudent to assume that efforts to attract investors to a venture capital fund are offers of a security and subject to federal and state securities laws.

Offerings of venture capital fund interests may not need to be registered with the SEC or state securities regulators if an exemption from registration is available.

Federal and state securities laws contain several exemptions from registration that fund managers could rely on when launching a venture capital fund.

For example, some frequently used exemptions from registration that may be available to VC fund operators include Rule 506(c) of Regulation D. This rules provides an exemption from registration for an offering that may be conducted publicly so long as the venture capital fund takes reasonable steps to verify the accredited investor status of each purchaser.

Is the venture capital fund required to register an “Investment Company”?

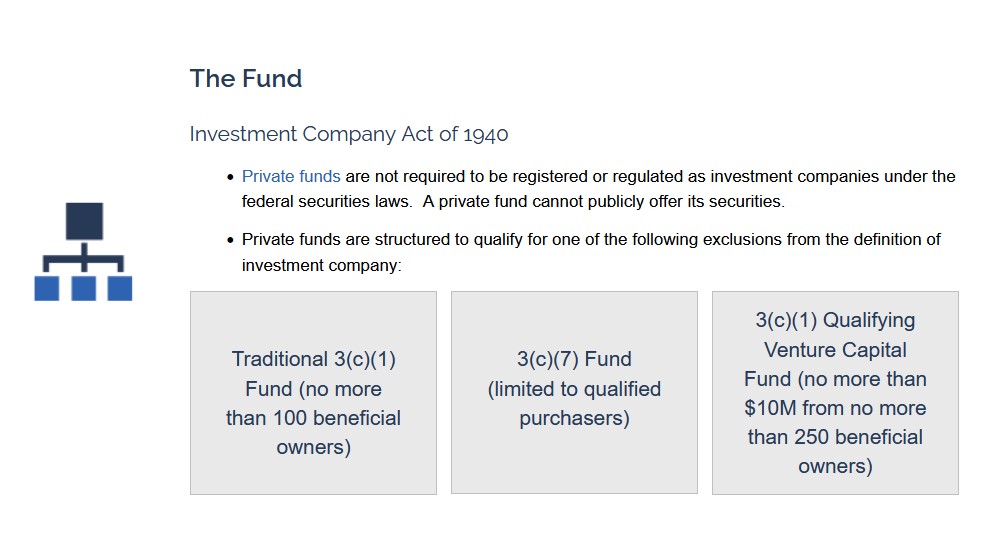

Venture capital funds can also implicate the registration provisions of the Investment Company Act of 1940 (Investment Company Act) and, potentially, the Investment Advisers Act of 1940 (Advisers Act) or related provisions of state securities laws.

Depending on the facts and circumstances, VC funds may have to register as investment companies under the Investment Company Act.

However, exclusions from the definition of “investment company” under the Investment Company Act that might apply:

Private Fund Exclusions – Section 3(c)(1) and Section 3(c)(7)

Section 3(c)(1) of the Investment Company Act states, in part, that an issuer is not an investment company if its outstanding securities (other than short-term paper) are beneficially owned by not more than 100 persons.

Section 3(c)(1) – Qualifying Venture Capital Fund is a type of private fund that is excluded from the definition of investment company under Section 3(c)(1) of the Investment Company Act because it meets the following criteria:

- (1) no more than 250 beneficial owners;

- (2) no more than $10 million in aggregate capital contributions and uncalled capital commitments; and

- (3) qualifies as a venture capital fund.

Section 3(c)(7) of the Investment Company Act states, in part, that an issuer will not be an investment company if its outstanding securities are owned exclusively by persons who, at the time of acquisition of such securities, are “qualified purchasers” and it is not making and does not at that time propose to make a public offering of its securities. For purposes of this provision, the term “qualified purchaser” is defined by Section 2(a)(51) of the Investment Company Act.

Is the adviser to a venture capital fund subject to Advisers Act or comparable regulation under the State Securities Laws?

In summary, Advisers Act Rule 203(m)-1 provides that an investment adviser that serves as an adviser solely to private funds and has assets under management of less than $150 million is exempt from registering as such with the SEC.

However, an investment adviser relying on this exemption must still comply with certain SEC reporting requirements.

Tokenized Venture Capital Funds

Dilendorf Law Firm advises on all aspects of the formation, governance, and operation of tokenized venture capital funds. Tokenized venture capital funds offer a number of potential benefits as compared to traditional funds.

Benefits include:

- Access to a global pool of capital;

- Increased liquidity on regulated US and global security token marketplaces aka Alternative Trading Systems;

- Simplified digital management of a significant number of investors via smart contracts;

- Automated and transparent governance, voting and compliance using smart contracts on the blockchain;

Tokenized fund interests are subject to limitations on resale, number of investors, investor solicitation and acceptance, tradebility on security token marketplaces in the US and foreign jurisdictions, etc.

When designing a tokenized venture captail fund structure, fund managers must take into an account account various pitfalls presented by securities regulations, AML/KYC requirements and current investment and governance restrictions. Heightened global liquidity may present additional operational complications, for example, with secondary market re-sales and maintaining capitalization tables.

We help our clients efficiently navigate the web of challenges arising throughout the formation, governance, and operation of tokenized real estate funds.

Resources:

- Venture Capital Funds Formation Guide

- Introduction to Private Equity Funds

- Private Equity Funds – Formation and Operation

- Closed-End Fund Formation

- Private Equity Demystified – Explanatory Guide

- How to Start a Hedge Fund

- SEC’s Analysis of the Market for Unregistered Securities Offerings

- Tax Treatment of Partnership Funds and Mergers of Investment Companies

- Hedge Fund Basics – IRS Guide

- Opportunities in Private Equity

- Private Equity in the Developing World: Determinants of Transaction Structures

- Hedge Fund Fully Managed by Artificial Intelligence

- Sample Limited Partnership Agreement of the Fund

- Sample Real Estate Fund Formation Agreement

- Private Equity, Venture Capital and Hedge Funds

- Hedge Fund Basics – IRS

- Supporting Innovation Through SEC’s Mission to Facilitate Capital Formation

- Information and Observation on State Venture Capital Programs

- Funds of Funds Arrangments

- Framework for Investor Analysis of Hedge Fund Governance

- Implications of the Growth of Hedge Funds – SEC.gov

What is a Proof of Claim?

An essential element in the process of collecting debts in a bankruptcy, the proof of claim legally documents a creditor’s rights to collect repayments from a debtor.

When a debtor files for chapter 11 bankruptcy protection, that filing may have a serious impact on a creditor’s ability to meet its business and personal financial obligations.

While a proof of claim is not a guarantee of repayment it can determine how, when, and whether a creditor will receive payment from such a debtor.

Are all creditors required to file a proof of claim when a debtor files for bankruptcy?

The answer to this question depends on how accurately the debtor has described the nature and amount of debt it still owes and whether they have described the debt as disputed.

What are some examples of when it is necessary to file a proof of claim against a debtor who is filing for Chapter 11 bankruptcy protection?

If any of the following problems are identified on a debtor’s schedule of assets and liabilities, it will be necessary to file a proof of claim:

- The debt is miscategorized on the schedule

- The amount owed is incorrect

- The creditor is not listed on the schedule

- The creditor’s claim is designed as disputed, contingent, or unliquidated

While a “proof of claim” filing is not required in a Chapter 11 bankruptcy case, filing one can provide the creditor with some peace of mind and the benefit of legal protection.

If the claim is never filed, the court will accept that the information provided by the debtor is accurate and complete.

A proof of claim, however, provides a more accurate record about existing debt which supersedes the information the debtor has listed in their schedule of assets and liabilities.

What is the best way to file a Proof of Claim?

Most often, creditors will automatically receive a Form 410 Proof of Claim once the debtor has filed for bankruptcy, which is sent to all creditors along with the notice of bankruptcy.

Accordingly, the notice provides instructions on how to file the claim and where it must be submitted.

A deadline, or “bar date” will also be included, indicating the last day a proof of claim can be file in this case.

Most creditors are unaware of the complexities of such a filing and may underestimate how long it will take to complete.

What must a Proof of Claim include?

A proof of claim must include a description of the type of claim being made against the debtor, the amount of the debt which remains outstanding, and its priority status.

Our attorneys will gather all of the information necessary to complete the form in a timely manner, including certain details about the debt and the debtor, including:

- The name of the debtor and the bankruptcy case number

- Information about the creditor, including business name and contact details

- The debt category, such as secured or unsecured

- The amount of the debt that remained outstanding on the date of the debtor’s bankruptcy petition

- Any supporting documents that support the claim, such as contracts, delivery receipts, open invoices, ledgers, statements, or other relevant agreements

Dilendorf Law Firm’s experienced team of bankruptcy lawyers understand the process of filing a proof of claim and frequently consult with clients who are attempting to collect from a debtor in the process of bankruptcy.

We recommend consulting with one of our attorneys as soon as one receives notice of a debtor’s bankruptcy petition.

Our team supports our clients throughout the process and helps them better understand their creditors’ rights in a Chapter 11 bankruptcy.

Resources

- Chapter 11 – Bankruptcy Basics

- Official Form 410 | Proof of Claim in Chapter 11 Bankruptcy Proceedings

- Instructions for Filing Form 410 | Proof of Claim

- Filing Proof of Claim or Equity Security Interest in Chapter 11 Reorganization Cases

- Impairment of Claims under Chapter 11 Reorganization Plan due to Alteration of Creditor’s Contractual and Equitable Rights

- Chapter 11 Guidelines and Reporting Requirements for Debtors in Possession and Chapter 11 Trustees

- Bankruptcy Basics | United States Courts

Tax Advantages of Investing in a Venture Capital QOF Holding Shares of QOZB Startups

The Tax Cuts & Jobs Act added Section 1400Z-2 to the Internal Revenue Code effectuating the QOZB program. That section provides three tax advantages for taxpayers who invest in Qualified Opportunity Funds:

- Deferred recognition of capital gains realized no more than 180 days before the investment;

- A reduction in the amount of the deferred gains that must be recognized based on the holding period of the QOF investment; and

- An exclusion of federal income tax on the capital gained from the QOF investment held for at least 10 years by elective increase in its basis to the fair market value.

Requirements for QOF and Its Portfolio Startups

QOZB program eligibility requirements include:

- Venture capital QOF must hold 90% of its assets as investments in QOZ startup(s) that is a QOZB;

- To be a QOZB, a startup should own or lease “substantially all” tangible property that is a QOZ business property;

- Also, to be a QOZB, a startup should derive 50% of its gross income from the active conduct of the business in the QOZ.

The U.S. Department of Treasury and IRS issued several proposed regulations containing guidance on how to interpret and implement each requirement.

For example, per an additional guidance, a startup can meet the QOZ active conduct requirement when 50% or more of the services are performed by its employees/independent contractors within the QOZ based on the (a) hours, (b) payments or (3) tangible property and managerial functions that are performed in a QOZ. Alternatively, a startup may be determined to generate at least 50% of its gross income from the active conduct of the business in the QOZ based on all the facts and circumstances.

Some of the requirements are still open to interpretation, extremely circumstantial and require careful consideration pending additional clarification from the executive agencies.

Formation of QOFs to Invest in Startups Operating in QOZs to Defer and Reduce Capital Gain Tax, Attract Venture Capital Investments and Promote Innovation and Revitalization

Our attorneys offer comprehensive Venture Capital QOF strategies and guidance at every step of the QOZB investment process. We also advise on maintaining the Venture Capital QOF illegibility for the QOZ program. Our services include:

- Explaining the QOF process to both venture capital investors and startups interested in benefiting from it;

- Assessing each client’s unique circumstances and goals to develop a qualified opportunity fund strategy custom-made for him or her;

- Forming corporations, partnerships, LLCs, or other entities, and drafting corporate governance documents to ensure eligibility for the QOZ program;

- Assisting clients in funding QOFs using the capital gains to be deferred under the QOZ program;

- Advising on compliance with respect to the established QOF.

Contact Us to Learn More About Our Qualified Opportunity Fund Services

Send us an email or call 212.457.9797 to schedule a consultation at our Manhattan office

Resources

- US. Treasury and IRS 1st Guidance – Investing in Qualified Opportunity Funds

- US. Treasury and IRS 2nd Guidance – Investing in Qualified Opportunity Funds

- US. Treasury and IRS 3rd Guidance – Investing in Qualified Opportunity Funds

- Opportunity Zones Frequently Asked Questions

- Investing in Qualified Opportunity Funds

- Map of Designated Qualified Opportunity Zones

- Opportunity Zone Program in New York State

We bring years of experience in commercial transactions to our work as outside general counsel. Our relationship with clients as trusted advisors coupled with our understanding of each client’s business, allows us to address their day-to-day legal needs quickly and efficiently, as well as anticipate legal risks and develop strategies to address those risks beforehand.

Our general counsel services include, among other things:

- Guiding companies through full business cycle – from formation to angel and venture financing to private/public offerings of securities, including digital securities;

- Choosing and setting-up appropriate holding and operating structures;

- Identifying, structuring and closing all stages of funding – terms, agreements, offering documents, regulatory filings;

- Protecting clients’ intellectual property, including trademarks, copyrights, and trade secrets;

- Legal support of strategic deals including mergers, acquisitions, joint ventures and spin-offs;

- General counsel services for day-to-day legal and compliance matters;

- Providing full legal due diligence and transactional support;

- Contract drafting, review and negotiation (i.e., software development, technology and license agreements, non-compete, trade secret and non-disclosure agreements, product commercialization and professional services agreements, vendor and services agreements, leases, incentive and executive compensation agreements, etc.).

Fund Tokenization Brochure

Services Related to Formation and Operation of Tokenized Funds

Developing a fund’s strategy and structure:

- Assisting clients with selecting and establishing optimal onshore and offshore (Cayman Islands/BVI) fund tokenization structures;

- Guiding fund sponsors and investment advisers with selecting suitable fund formation structures in compliance with the U.S. securities laws, including:

- Regulation D/S of the Securities Act of 1933

- Section 3(c)(1) funds / Investment Company Act of 1940

- Section 3(c)(5) real estate funds / Investment Company Act of 1940

- Section 3(c)(7) / Investment Company Act of 1940

- Investment Advisers Act of 1940

- Implementing the chosen fund structure and preparing all the necessary documentation;

- Preparing private offering memorandum and subscription documents;

- Advising on foreign and US investor qualifications;

- Advising on AML/KYC compliance.

Types of Tokenized Funds

- Real Estate Funds;

- Art Funds;

- Healthcare, Life Science and Biotech Funds;

- Precious Stone Funds; and

- Collectible Funds (Sneakers, Classic Cars, Wine, Whiskey)

Fund Tokenization Benefits Include

- Access to a global pool of capital;

- All operations, such LP token issuance, investor subscription and redemption, are managed via blockchain smart-contracts, without any physical paperwork;

- Increased liquidity;

- Simplified digital management of significant number of investors via smart contracts;

- Automated and transparent governance, voting and compliance using smart contracts on blockchain.

Key Considerations: Technology

All of the key tokenization practices must be maintained via blockchain smart-contracts, including:

- Selecting blockchain for a security token issuance, e.g., Avalanche, Algorand, Ethereum, etc.

- KYC/AML/Accreditation process

- Token issuance with a compliance protocol

- Maintaining cap table

- Secondary trading integration

- Reporting and investor management

- Managing token lifecycle (communications with investors, cap table managment, secondary trading restrictions).

Fund token issuers must structure each offering very carefully to take into account various pitfalls presented by securities regulations, AML/KYC requirements and current investment and governance restrictions. Heightened global liquidity may present additional operational complications, for example, with secondary market re-sales and maintaining capitalization tables.

Some of the other major considerations that should be acknowledged and addressed by emerging tokenized fund managers are that security tokens may by subject to limitations on re-sale, number of investors, investor solicitation and acceptance, tradability on secondary markets in the US and foreign jurisdictions, etc.

We help our clients efficiently navigate the web of challenges arising throughout formation, governance and operation of tokenized funds. Contact Dilendorf Law Firm for a consultation.

Resources:

- Tokenization of Assets is Disrupting the Financial Industry

- Engaging on Fund Innovation and Cryptocurrency-related Holdings

- Digital Assets and The Future of Finance

- Bank Secrecy Act/Anti-Money Laundering – FDIC

- Tokenized Security & Commercial Real Estate – MIT Digital Currency Initiative

- From Initial Coin Offerings to Security Tokens – Stanford Law School

- Private Equity and Blockchain: New Infrastructure or New Asset Class? – Harvard Law School

- Initial Crypto-asset Offerings, Tokenization, and Corporate Governance – Columbia Law School

- Potential for Cryptocurrency to Fund Investment in Sustainable Real Assets – Duke University

We strive to provide exceptional service, valuable advice and effective solutions for our clients throughout their full business cycles – from formation to angel and venture financing to IPO. We make it our priority to understand the industry, business and client’s goals to develop tailored and effective strategies to suit their needs.

We leverage our corporate and industry experience assisting startups, as our clientele also includes established businesses, corporations and their directors and shareholders, US and foreign investors, and other successful entrepreneurs and businesses.

Our services offered to startups and emerging companies include:

- Advising on appropriate business structures;

- Assisting in setting-up corporate and organizational systems;

- Preparing agreements for founders to reinforce/solidify their relationship and to avoid future disputes;

- Protecting intellectual property rights by registering trademarks and copyrights and drafting confidentiality agreements to protect trade secrets;

- Handling employment matters, including drafting employment contracts and incentive compensation agreements;

- Guiding entrepreneurs through various rounds of financing, from angel level to venture capital;

- Providing full support to our clients in their strategic deals – mergers, acquisitions, joint ventures and spin-offs;

- Preparing successful companies for IPOs.

As entrepreneurs ourselves, we recognize and appreciate the fast-paced schedule and hard work it takes to develop from an idea into a thriving business.

Whether one plans to make an investment into a fresh startup, established hedge fund or a sophisticated M&A transaction, prospective investors must conduct a thorough due diligence to make sure their investment decision is informed and to ensure that all risks are disclosed.

At the basic level, legal due diligence and background checks are aimed to ensure that the entity is duly formed and in good standing, with sound corporate governance and capitalization in place.

Due diligence ensures that the managers, shareholders and sponsors are not red-flagged and are legally authorized to enter into the investment transaction. In addition, a thorough legal due diligence may reveal previously undisclosed risks and liabilities, including contractual, compliance, employment, intellectual property, tax and litigation issues.

Our legal due diligence services include:

- Preparation of a customized due diligence checklist;

- Background checks of the management, sponsors and shareholders: including running them through multiple high-risk databases (OFAC sanctions list, politically exposed persons (PEP) list, global watchlists, etc.);

- Review of the essential corporate documentation (fund offering documents, company articles of incorporation, bylaws, minutes of director and stockholder meetings, partnership agreements, shareholder agreements, capitalization tables, etc.);

- Review of material contracts with partners, management, employees, previous investors, lenders and service providers;

- Review of IP rights;

- Regulatory compliance review, including licensing, registrations, compliance policies, SEC Form D filings and “blue sky” state filings;

- Other red flags, including industry misconduct.

This list is not exhaustive and some items may or may not be required depending on a transaction.

Resources:

- Red Flags of Investment Fraud Checklist – Investor.gov

- Investor Alert: Bitcoin and Other Virtual Currency-related Investment – SEC

- Investment Adviser Due Diligence Processes For Selecting Alternative Investments and Their Respective Managers – SEC

- Researching Investments – Investor.gov

- Investor Education Quiz – NY Attorney General

- How Investors Evaluate a Company – Yale University

- Reputational and Integrity Due Diligence on Investors – Columbia Law School

We assist in all aspects of the funds’ formation, governance and operation.

Including:

- Defining the fund structure, strategy and associated risks;

- Preparing private offering memorandums, operating agreements, partnership agreements, investment advisory agreements, investment management agreements and other documentation for the fund’s launch and operation;

- Preparing and filing Form D with SEC and submitting “blue sky” state filings, if required;

- Review of marketing materials and advise on marketing of private equity and venture capital funds;

- Advising on foreign and US investor qualifications;

- Advising on AML/KYC compliance;

- If necessary, guiding through SEC and state registrations;

- Advising on applicability of federal and state regulations, including broker-dealer legislation, FINRA rules, the Investment Advisers Act of 1940 and the Investment Company Act of 1940;

- Establishing offshore feeders for foreign investments;

- Supervising offshore attorneys, fund administrators and auditors;

- Advising in relationships with brokers, custodians and other service providers.

Incubator funds

Forming an incubator fund provides clients, usually emerging fund managers, with a cost-effective solution at the pre-launching stage of a fund. Incubator funds can be utilized to test the fund’s strategy and develop track record before marketing the fund to outside investors.

An incubator fund can usually be established within a few weeks, while the incubator phase typically lasts up to a year. The cost of establishing an incubator fund is usually affordable for emerging fund managers but tends to depend on the number of participants, chosen structure and jurisdiction (domestic or offshore).

We handle all the paperwork expeditiously to get the incubator fund running and seamlessly guide our clients through the incubation phase, including all operational and marketing limitations. We offer assistance in transition to a full-fledged investment fund.

Cryptocurrency funds

We leverage our experience in the blockchain and cryptocurrency space to tailored, high-quality services to help each client navigate the complex web of laws, regulations and practical issues implicated by cryptocurrency funds.

Tokenized funds

We also offer end-to-end fund tokenization solutions, which provide additional liquidity for traditional funds, access to capital on a global scale, ease of investor management and other advantages made accessible by blockchain technology.

Resources

- Venture Capital Funds Formation Guide

- Introduction to Private Equity Funds

- Private Equity Funds – Formation and Operation

- Closed-End Fund Formation

- Private Equity Demystified – Explanatory Guide

- How to Start a Hedge Fund

- SEC’s Analysis of the Market for Unregistered Securities Offerings

- Tax Treatment of Partnership Funds and Mergers of Investment Companies

- Hedge Fund Basics – IRS Guide

- Opportunities in Private Equity

- Private Equity in the Developing World: Determinants of Transaction Structures

- Hedge Fund Fully Managed by Artificial Intelligence

- Sample Limited Partnership Agreement of the Fund

- Sample Real Estate Fund Formation Agreement

- Private Equity, Venture Capital and Hedge Funds

- Hedge Fund Basics – IRS

- Supporting Innovation Through SEC’s Mission to Facilitate Capital Formation

- Information and Observation on State Venture Capital Programs

- Funds of Funds Arrangments

- Framework for Investor Analysis of Hedge Fund Governance

- Implications of the Growth of Hedge Funds – SEC.gov

Negotiating and Documenting All Types of Venture Capital and M&A Transactions

Whether a company is collecting funds from friends and family, raising seed financing from angel investors or from more experienced investors in Series A, Series B, etc., or considering a strategic merger or spin-off, the company must carefully consider the structure, implications and effect of such transaction on the overall strategy and roadmap of the venture.

Proper documentation and negotiation support will allow the founders to ensure that they achieve their desired objectives, build transparent relationship with their investors and minimize governance and other issues that can arise at the later stages of the company’s growth cycle.

Typical transactional documents involving various startup and scaling-up financing structures include:

- Term Sheets (outlining financing structure, corporate governance, liquidation, etc.);

- Letters of Intent (outlining prospective M&A transaction framework and contingencies);

- Confidentiality Agreements;

- Investment Contracts/Investor Rights Agreements (specifying founding shareholder rights vs. minority investor rights, reporting and financial disclosure requirements, observer rights, etc.);

- Stock Purchase Agreements;

- Amended and Restated Certificates of Incorporation;

- Merger Agreements and other documents required for M&A transactions;

- Asset Purchase Agreements;

- Convertible Notes;

- Crowdfunding Filings with SEC.

Our legal advice and assistance in properly structuring and documenting each transaction are aimed at facilitating startup and early-stage companies’ liquidity events and high-growth.

Resources:

- Modernizing the SEC’s Definition of Venture Capital Fund – SEC

- Merge and Acquire Businesses – Small Business Administration

- How to Access Public Documents for Mergers & Acquisitions – FCC

- The Dodd-Frank Wall Street Reform and Consumer Protection Act – Cornell Law School

- Summary of Dodd-Frank Financial Regulation Legislation – Harvard Law School

- Using EDGAR to Research Investments – SEC

- Mergers, Acquisitions, and Joint Ventures: A Resource Guide – Library of Congress