The Basics

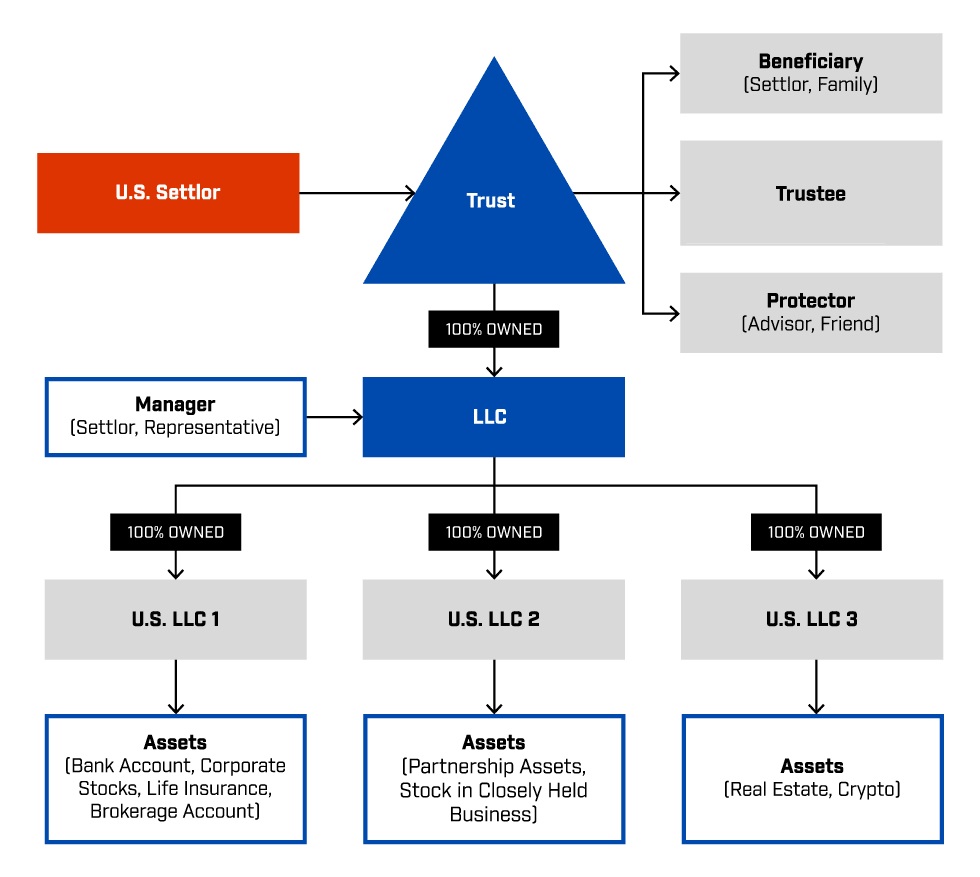

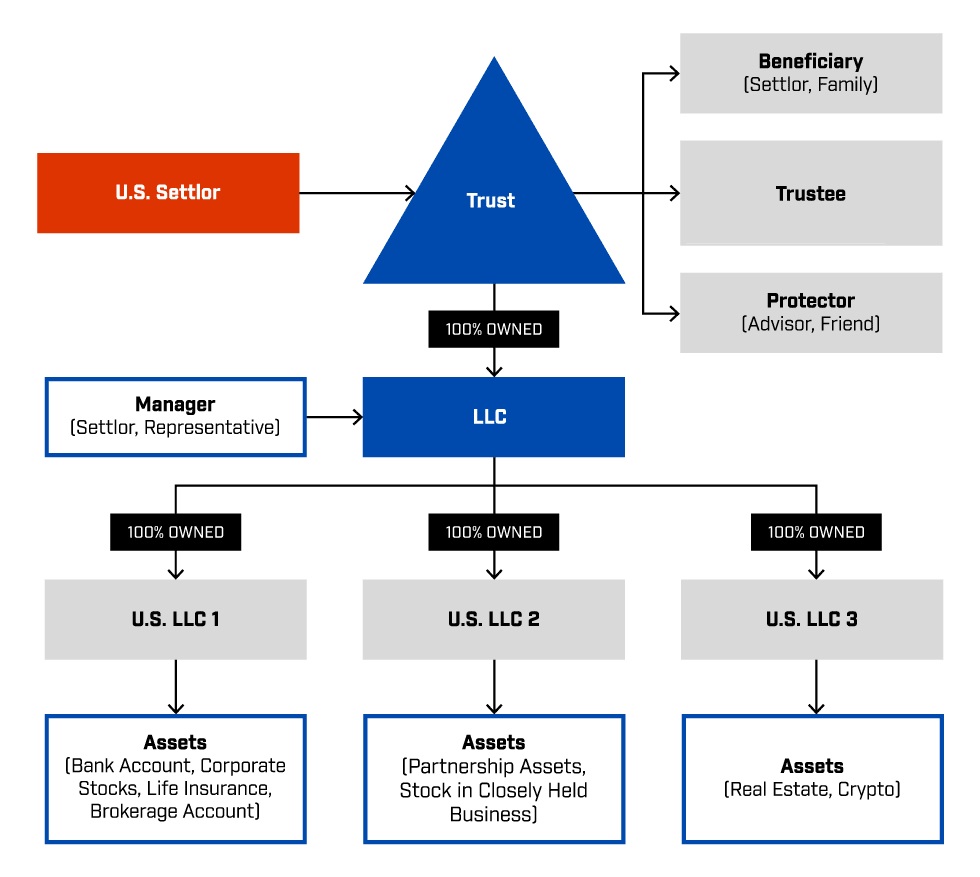

While commonly known as a “domestic asset protection trust” the asset structure used in Wyoming is technically a “qualified spendthrift trust”. The name is significant because some of the key characteristics are based on a lifetime, rather than a post-mortem, asset protection strategy.

Here is what one can expect from a qualified spendthrift trust when it is established in the state of Wyoming:

- The creator, or settlor, of the trust, can also be the sole beneficiary

- The settlor retains control and authority over the investments in the trust, as an “investment advisor” and may veto decisions made by the person responsible for managing its assets, known as the trustee.

These two characteristics are essential when forming an asset protection trust because it would not be an effective means of asset protection if the settlor could not control the trust’s investments or receive distributions.

Another important aspect of a DAPT is its ability to insulate the trust’s assets from creditors. The Wyoming domestic asset protection trust is among the most effective in this area, provided it has been properly set up and the assets in need of protection have been contributed in a timely manner. A Wyoming-based DAPT can protect assets in most circumstances, but there are a few exceptions.

- Child support orders may remain enforceable against the assets in the trust.

- If the assets in the trusts were specifically included in the application to obtain or maintain credit, a creditor may be able to pursue these assets in a lawsuit.

- If the assets transferred into the fund are in violation of Wyoming’s Uniform Fraudulent Conveyance Act.

- Creditors may be able to attach the assets in a DAPT in a bankruptcy proceeding if it can be proven that assets were transferred in an attempt to defraud.

When structured properly a Wyoming DAPT is able to provide the flexibility and protection required to safeguard an individual’s wealth during his or her lifetime, while allowing them necessary access to the assets and income held in the trust.

Which assets can be protected in a Wyoming DAPT?

Another established benefit of the Wyoming domestic asset protection trust is its broad range of acceptable assets it can protect. One can legally transfer the following assets into a Wyoming DAPT.

- Cash and/or cash equivalents

- Investment real estate

- Investment accounts and proceeds

- Raw land, including undeveloped land and land with mineral or gas rights

- Items of personal property, such as vehicles, boats, and other high-value items

- Closely held business interests, such as membership interest in an LLC or shares in a private corporation

What are some alternatives to a Wyoming DAPT?

If the requirements for a Wyoming domestic asset protection trust are too restrictive, a variety of other options exist for protecting personal wealth. One example is setting up an LLC, where Wyoming also offers a favorable statute. Another option may be a foreign asset protection trust, which offers some unique benefits that do not exist with a DAPT.

Some other options, while not necessarily designed to be asset protection vehicles, offer more flexibility without compromising security. One example is the revocable living trust, which can serve as both an asset protection and estate planning strategy.

Our experienced team of asset protection lawyers at the Dilendorf Law Firm help clients to determine the best ways to safeguard assets while maintaining the most flexibility over assets and income. To learn more about Wyoming DAPTs and the other options that are available, we encourage you to schedule a confidential initial consultation.

Resources: