Our clients are advisers to real estate funds, and we regularly counsel clients with respect to the formation and offering of interests in traditional and tokenized real estate funds they advise.

Whether certain real estate fund activities require registration of the offering of securities, broker-dealer registration, investment company registration, or investment adviser registration is a fact-specific analysis that must be conducted on a case-by-case basis.

Are interests in private real estate funds “Securities”?

All offers, sales, and issuance of securities are governed by federal securities rules and regulations.

Under federal and state laws, securities are defined broadly to include shares of limited partnership interests and membership interests in an LLC, LLP and investment contracts.

Interests in a private real estate fund offered and sold to investors will typically constitute securities within the meaning of federal and state laws.

As a result, private real estate funds must comply with all applicable regulations of the Securities and Exchange Commission (“SEC”) and the securities regulators in the states where a real estate fund operates. This includes being aware of, and complying with, applicable provisions such as the registration and anti-fraud provisions of federal and state securities laws.

Are real estate fund offerings required to be registered with the SEC Commission and the states or are exemptions from registration available?

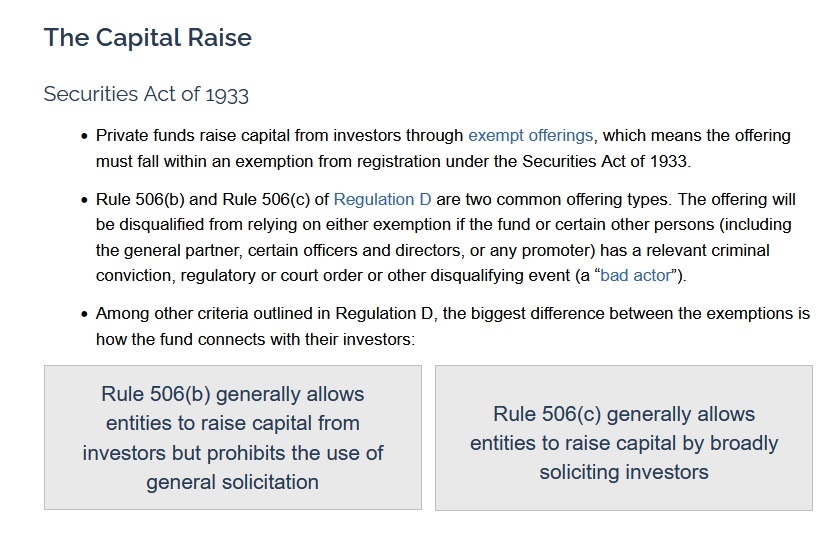

Under the federal Securities Act of 1933 (Securities Act), all offers and sales of securities must be either (1) registered with the SEC or (2) conducted in compliance with an exemption from registration. State securities laws also require registration or an exemption from registration before securities may be offered or sold in the state.

Securities regulators interpret broadly the meaning of the term “offer.” For example, advertising a business opportunity could be considered an offer; therefore, it is prudent to assume that efforts to attract investors to a real estate fund are offers of a security and subject to federal and state securities laws.

Offerings of private real estate fund interests may not need to be registered with the SEC or state securities regulators if an exemption from registration is available.

Federal and state securities laws contain several exemptions from registration that fund managers could rely on when launching a real estate fund.

For example, some frequently used exemptions from registration that may be available to real estate fund operators include Rule 506(c) of Regulation D. This rules provides an exemption from registration for an offering that may be conducted publicly so long as the real estate fund takes reasonable steps to verify the accredited investor status of each purchaser.

Is the real estate fund required to register an “Investment Company”?

Real estate funds can also implicate the registration provisions of the Investment Company Act of 1940 (Investment Company Act) and, potentially, the Investment Advisers Act of 1940 (Advisers Act) or related provisions of state securities laws.

Depending on the facts and circumstances, real estate funds may have to register as investment companies under the Investment Company Act.

Under Section 3(c)(5)(C), a real estate fund, will not be considered an investment company if it is primarily engaged in purchasing or otherwise acquiring mortgages and other liens on and interests in real estate.

However, with some exceptions, the Commission has taken the position that an issuer that is primarily engaged in the business of holding interests in a pooled investment vehicle that invests in real estate generally may not rely on Section 3(c)(5)(C)

Is the adviser to a venture capital fund subject to Advisers Act or comparable regulation under the State Securities Laws?

In summary, Advisers Act Rule 203(m)-1 provides that an investment adviser that serves as an adviser solely to private funds and has assets under management of less than $150 million is exempt from registering as such with the SEC.

However, an investment adviser relying on this exemption must still comply with certain SEC reporting requirements.

Tokenized Real Estate Funds

Dilendorf Law Firm advises on all aspects of the formation, governance, and operation of tokenized real estate funds. Tokenized real estate funds offer a number of potential benefits as compared to traditional funds.

Benefits include:

- Access to a global pool of capital;

- Increased liquidity on regulated US and global security token marketplaces aka Alternative Trading Systems;

- Simplified digital management of a significant number of investors via smart contracts;

- Automated and transparent governance, voting and compliance using smart contracts on the blockchain;

Tokenized fund interests are subject to limitations on resale, number of investors, investor solicitation and acceptance, tradebility on security token marketplaces in the US and foreign jurisdictions, etc.

When designing a tokenized real estate fund structure, fund managers must take into an account account various pitfalls presented by securities regulations, AML/KYC requirements and current investment and governance restrictions. Heightened global liquidity may present additional operational complications, for example, with secondary market re-sales and maintaining capitalization tables.

We help our clients efficiently navigate the web of challenges arising throughout the formation, governance, and operation of tokenized real estate funds.

Resources: