Defining the Scope of STOs

Defining the Scope of STOs

STO can be any offering and sale of digital tokens that are considered securities under US law. The broad Howey test, which has become commonplace for digital token issuers, still defines a “security” as any contract, transaction, or scheme whereby (a) a person invests money or anything else of value, (b) in a common enterprise, (c) and is led to expect profits, (d) predominantly from the efforts of others.

Security tokens sold during STO are any virtual tokens that exist on a blockchain and meet the definition of a security under US law, whether the tokens represent function on a platform (known as “utility tokens”), ownership of a real-world asset (asset-backed tokens), interest in a fund (fund tokens), equity (equity tokens) or debt (crypto bonds).

Accordingly, the scope of STO is very broad and may include, for example:

- Tokenized traditional securities, like shares of stock in a corporation;

- Tokenized fund interests, including venture capital and real estate funds;

- Real estate;

- Diamonds or precious metals;

- Works of fine art, luxury cars and boats;

- Interests in a limited partnership or other business entity;

- Profit-sharing right in a business entity, etc.

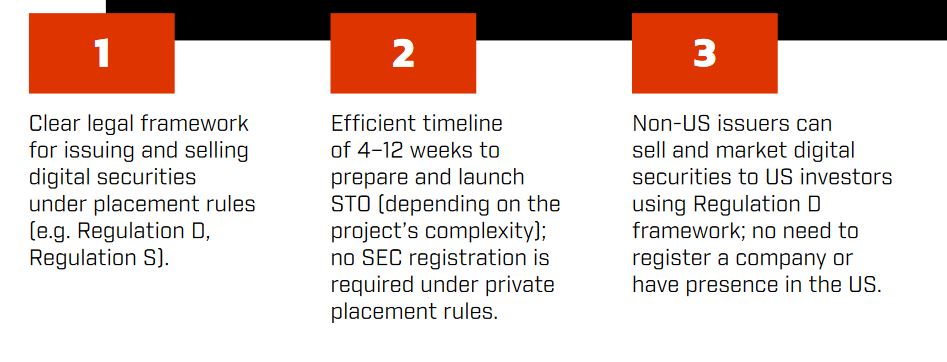

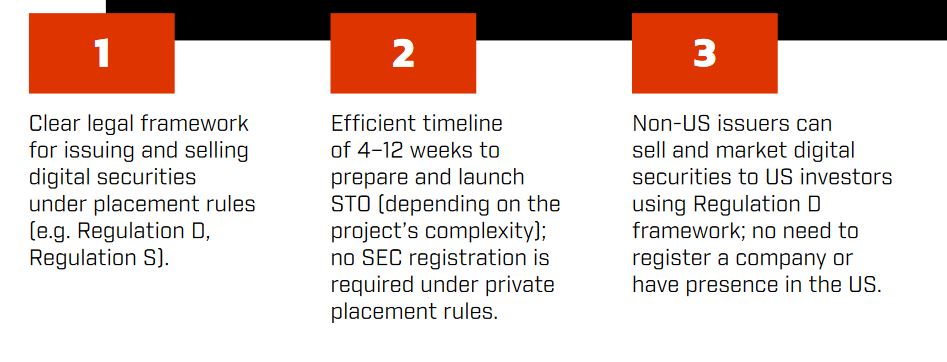

Why Choose United States for Your STO?

Understanding the Advantages of STOs

By going through STO process, companies and funds can raise capital from investors while benefiting from the advantages that blockchain affords, including:

- Increased liquidity;

- Simplified access to capital on a global scale;

- Fractionalization of ownership;

- Increased transparency and security;

- Simplified investors’ management, etc.

Addressing the Risks Associated with STOs

While STOs are becoming one of the most viable methods of raising capital and dividing ownership or profits, security token issuers must structure each STO very carefully to take into account various pitfalls presented by securities regulations, AML/KYC requirements, tax rules applicable to a different type of assets or entity type, etc.

Some of the major practical considerations that should be addressed by an issuer prior to launching STO are that security tokens may be subject to limitations on resale, trading on alternative exchange platforms in the U.S. and foreign jurisdictions, number of investors, and amount of capital raised.

Our lawyers are well-versed in the legal and practical issues that arise in the context of planning, developing, and offering security tokens in the US. We help our clients develop a comprehensive STO strategy that anticipates and responds effectively to the arising challenges.

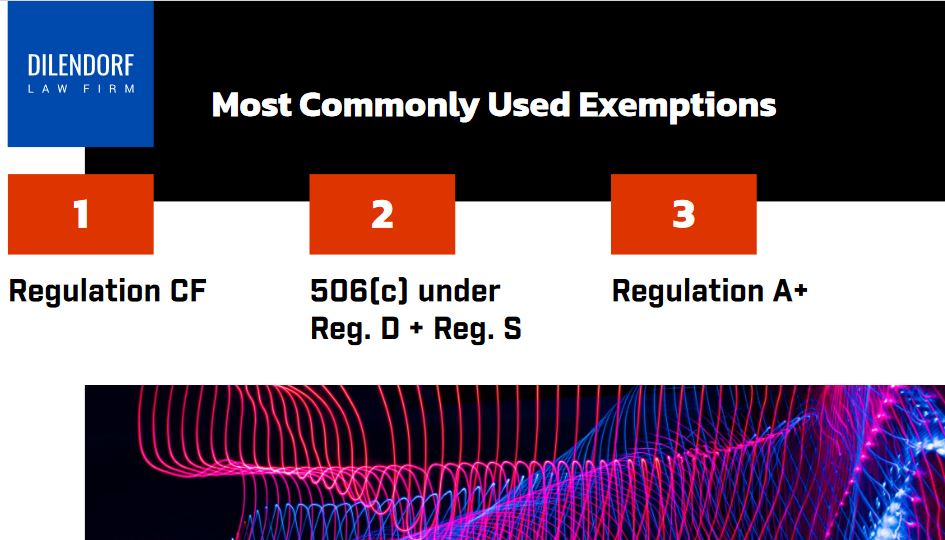

STOs Can Be Conducted Under Exemptions from SEC Registration: Reg D, Reg S, Reg A+, Reg CF

Before any security, including a security token, may be offered or sold in the US, it must be registered with the Securities and Exchange Commission (SEC) or qualify for an exemption. Registering security is a costly and time-consuming process. But if an exemption applies to an offering, then it does not need to be registered.

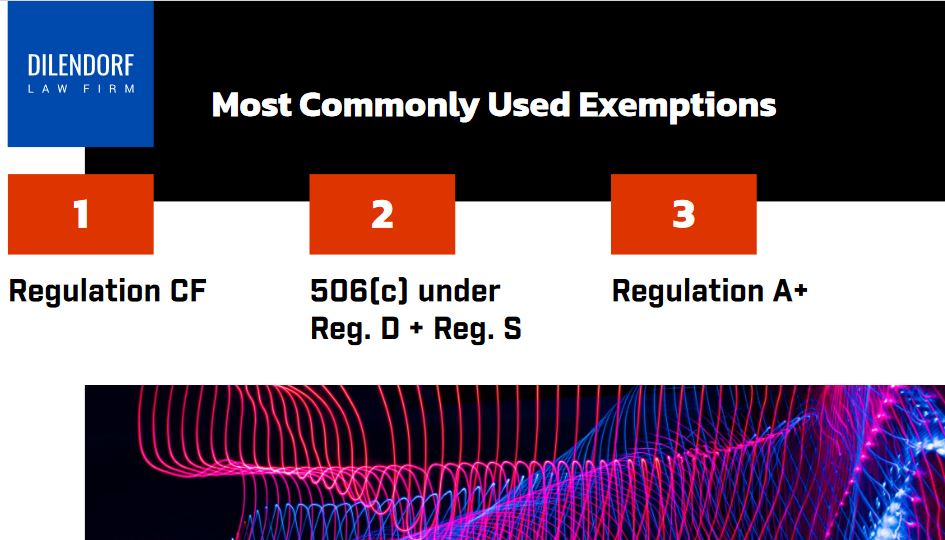

Most commonly, STOs are structured under one of the following exemptions from registration offered by the US Securities Act: Regulation D, Regulation S, Regulation A+ or Regulation CF.

Although exemptions under the SEC regulations eliminate the need to register STO with the SEC, qualifying for an exemption still requires careful compliance with US securities laws.

Secondary Trading of STOs

To ensure a successful STO launch, issuers need to meet compliance standards, establish a stable governance structure, and ensure that their shares are tradable on Alternative Trading System (ATS) platforms in the US, Europe, and Asia.

It is crucial that the minted STO tokens are compatible with the chosen ATS platform, as different tokenization platforms and ATSs have different standards and protocols.

To address this, STO issuers should establish contacts with their preferred ATS platform prior to the primary issuance and ensure that their digital securities match the platform’s configurations and adhere to the pre-listing procedures required by the ATS.

While some ATS platforms offer all-in-one tokenization, marketing, and listing services, it is still important to conduct thorough due diligence to avoid issues that may arise.

Poorly structured or documented offerings may result in unenforceable digital security features for secondary trading, and incompatible security tokens may lead to blockchain projects recalling flawed tokens and replacing them with new ones.

However, this may not always be possible or may be costly and complicated from a legal standpoint, as recalled securities, even in the form of digital tokens, cannot always be easily recalled.

Defects in STOs may also be incurable for legal compliance purposes and disqualify the security from being listed on a regulated trading platform.

Therefore, it is crucial to consider getting STO tokens to the secondary market well in advance to avoid potential loss of value and liability for violating securities and other laws.

Notes on Choosing ATS and Broker Dealers for Your STO

Professional advisers can assist STO issuers in determining which ATS platforms and broker-dealers are best for their needs.

When making these decisions, it is important to consider jurisdictional considerations, such as actively developing markets for security tokens and regulated STOs in Singapore, Malaysia, Thailand, and Gibraltar.

In addition, factors such as offering density and built-in blockchain interoperability protocols with other ATS platforms should be taken into account when choosing an ATS.

Depending on the asset and offering size, it may make sense to list on multiple ATS platforms in different locations.

Working with a multinational broker-dealer can also attract international investors, opening up new investment opportunities that may not be available in traditional real estate.

Tokenization offers the ability to raise capital through international investors, creating new markets and opportunities for STO issuers.

Efficiency gains can be achieved through tight-knit consortiums of broker-dealers and ATS, which can also be advantageous for STO issuers.

However, it is crucial to conduct thorough due diligence before choosing a broker-dealer and ATS to avoid the costly process of burning and switching tokens due to a poor choice.

Helping Clients Through Every Stage of STO

Our attorneys represent a wide range of clients in all kinds of STOs, providing comprehensive services throughout the STO process, including:

- Conducting a comprehensive token analysis to determine whether the token is a security under US law;

- Determining the appropriate token structure;

- Determining the appropriate corporate structure for STO (SPV/trust, fund, hybrid, etc.);

- Structuring STO to qualify for an exemption from registration as security using Regulation D and Regulation S;

- Drafting private placement memorandum, investment agreements, and related documents;

- Developing AML/KYC policies and helping clients implement them to verify investors’ identities and eligibility to participate in the STO;

- Providing post-STO legal support, including by advising our clients on secondary trading issues, subsequent usage of security tokens, and the applicability of money-transmitter and other laws.

Tax consequences

Token issuers must consult professional tax advisers to develop a sound tax-planning strategy in the weeks and months before an STO. Any such strategy must account for (among other issues):

- The type of tokenized interest and the rights associated with the token;

- How income generated in the token sale will be treated for tax purposes;

- What reporting and withholding requirements may apply.

The IRS issued IRS Notice 2014-21, IRB 2014-16, as guidance for individuals and businesses on the tax treatment of transactions using virtual currencies.

The IRS also published Frequently Asked Questions on Virtual Currency Transactions for individuals who hold cryptocurrency as a capital asset and are not engaged in the trade or business of selling cryptocurrency.

Launching a security token offering is a highly complex process that requires thorough research and careful planning. PLease read our Guide for Launching Security Token Offerings (STOs) in the US.

Resources: