What are some common investment strategies for hedge funds?

- Long/short equity funds, which includes participation in both the long and short sides of equity investing, may be focused on specific regions or sectors.

- Global macro funds reflect a fund manager’s views on the overall direction of the market, as they carry long and short positions in futures, securities, and derivatives based on the influence of economic trends and events.

- Special situation funds are strategically designed to reflect price movement resulting from a significant event, such as a corporate restructuring, liquidation, merger, or reorganization.

- Equity market neutral funds use a strategy that exploits the inefficiencies in the equity market, usually by investing in short and long-matched portfolios simultaneously.

- Managed futures funds use commodity trading advisors to invest in a combination of financial and commodity futures markets, as well as currency markets around the world.

- Fixed income arbitrage funds seek to profit from price fluctuations between related interest-rate securities, which may include U.S. Government bond and mortgage-backed securities arbitrage.

- Convertible arbitrage funds typically take long positions in a company’s convertible securities while maintaining short positions in the common stock of that same organization, thereby protecting principal from market volatility.

- High frequency, statistical arbitrage, and quantitative analysis strategies make use of sophisticated, and often automated, trading systems and analytical models to determine the statistical relationships between securities, such as pricing, timing, and historical trends.

How are hedge funds usually structured?

Typically, a hedge fund is structured as a limited partnership and makes shorter-term investments, predominantly in liquid assets, which is in contrast closed-end private equity funds. With this type of structure, hedge fund managers are afforded limited personal liability in their position as members of the General Partner’s LLC. As such, individual investors are also called limited partners and purchase limited partnership shares when they join the fund.

What are the benefits of a Limited Partnership structure?

Well-structured hedge funds are designed to maximize tax efficiencies for investors. For example, domestic hedge funds in the United States are structured as Delaware limited partnerships, meaning the general partner and investment manager are set up as separate limited liability companies. While a general partner will have full control over the fund’s activities and management of the fund’s portfolio, the investment manager uses a wide range of strategies, such as leveraging of non-traditional assets, to earn above-average returns for investors.

Our hedge fund legal team’s specialized knowledge and extensive network of industry connections allows them to provide a personalized experience for each of our clients. We consider the size and scope of the fund and select an ideal suite of service providers, including plan administrators, auditing firms, brokers, and marketers. It is this level of attention to detail that allows us to customize each client’s offering documents to fit their particular objectives.

Are hedge fund offerings required to be registered with the SEC Commission and the states or are exemptions from registration available?

Under the federal Securities Act of 1933 (Securities Act), all offers and sales of securities must be either (1) registered with the SEC or (2) conducted in compliance with an exemption from registration. State securities laws also require registration or an exemption from registration before securities may be offered or sold in the state.

Securities regulators interpret broadly the meaning of the term “offer.” For example, advertising a business opportunity could be considered an offer; therefore, it is prudent to assume that efforts to attract investors to a hedge fund fund are offers of a security and subject to federal and state securities laws.

Offerings of hedge fund interests may not need to be registered with the SEC or state securities regulators if an exemption from registration is available.

Federal and state securities laws contain several exemptions from registration that fund managers could rely on when launching a hedge fund.

For example, some frequently used exemptions from registration that may be available to hedge fund operators include Rule 506(c) of Regulation D. This rules provides an exemption from registration for an offering that may be conducted publicly so long as the hedge fund takes reasonable steps to verify the accredited investor status of each purchaser.

Is the hedge fund required to register an “Investment Company”?

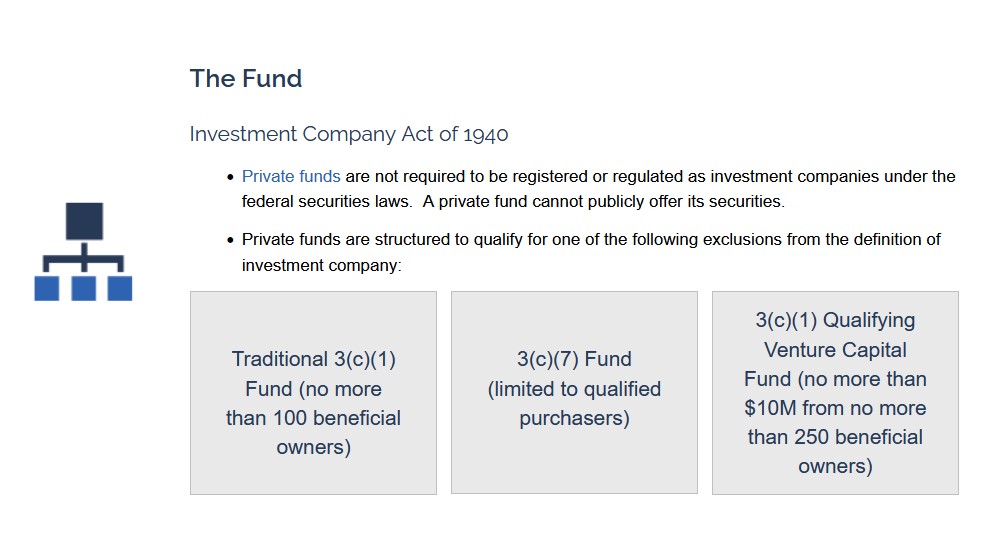

Hedge funds can also implicate the registration provisions of the Investment Company Act of 1940 (Investment Company Act) and, potentially, the Investment Advisers Act of 1940 (Advisers Act) or related provisions of state securities laws.

Depending on the facts and circumstances, hedge funds may have to register as investment companies under the Investment Company Act.

However, exclusions from the definition of “investment company” under the Investment Company Act that might apply:

Private Fund Exclusions – Section 3(c)(1) and Section 3(c)(7)

Section 3(c)(1) of the Investment Company Act states, in part, that an issuer is not an investment company if its outstanding securities (other than short-term paper) are beneficially owned by not more than 100 persons.

Section 3(c)(1) – Qualifying hedge fund is a type of private fund that is excluded from the definition of investment company under Section 3(c)(1) of the Investment Company Act because it meets the following criteria:

- (1) no more than 250 beneficial owners;

- (2) no more than $10 million in aggregate capital contributions and uncalled capital commitments; and

- (3) qualifies as a venture capital fund.

Section 3(c)(7) of the Investment Company Act states, in part, that an issuer will not be an investment company if its outstanding securities are owned exclusively by persons who, at the time of acquisition of such securities, are “qualified purchasers” and it is not making and does not at that time propose to make a public offering of its securities. For purposes of this provision, the term “qualified purchaser” is defined by Section 2(a)(51) of the Investment Company Act.

Is the adviser to a hedge fund fund subject to Advisers Act or comparable regulation under the State Securities Laws?

In summary, Advisers Act Rule 203(m)-1 provides that an investment adviser that serves as an adviser solely to private funds and has assets under management of less than $150 million is exempt from registering as such with the SEC.

However, an investment adviser relying on this exemption must still comply with certain SEC reporting requirements.

Tokenized Hedge Funds

Dilendorf Law Firm advises on all aspects of the formation, governance, and operation of tokenized hedge funds. Tokenized hedge funds offer a number of potential benefits as compared to traditional funds.

Benefits include:

- Access to a global pool of capital;

- Increased liquidity on regulated US and global security token marketplaces aka Alternative Trading Systems;

- Simplified digital management of a significant number of investors via smart contracts;

- Automated and transparent governance, voting and compliance using smart contracts on the blockchain;

Tokenized fund interests are subject to limitations on resale, number of investors, investor solicitation and acceptance, tradebility on security token marketplaces in the US and foreign jurisdictions, etc.

When designing a tokenized hedge fund structure, fund managers must take into an account account various pitfalls presented by securities regulations, AML/KYC requirements and current investment and governance restrictions. Heightened global liquidity may present additional operational complications, for example, with secondary market re-sales and maintaining capitalization tables.

We help our clients efficiently navigate the web of challenges arising throughout the formation, governance, and operation of tokenized real estate funds.

Resources: